The Best Cities to Buy Industrial Property in 2025

December 10, 2024

As we enter 2025, the industrial real estate landscape is stabilizing, offering opportunities in the fastest-growing industrial real estate markets. Demand will vary by region and the amount of available inventory, with a growing preference for eco-friendly buildings among industrial tenants.

The Urban Land Institute and PwC's latest Emerging Trends in Real Estate report suggests a promising outlook for industrial investments in key markets. From Knoxville’s logistics hubs to Jacksonville’s expanding port facilities, these regions showcase diverse advantages for industrial warehouse investment and broader property development. Strategic locations like Houston further solidify their status as top destinations for industrial property investment.

Every market mentioned has distinct advantages for investors, be it a robust population and job growth or a strategic location preferred by businesses. We'll dig deeper into the specifics of each market in the following sections.

10 Top Cities for Industrial Investing in 2025

Here is a list of the top 10 cities industrial investors should look at in 2025. Commercial real estate statistics are from Crexi's internal database. Demographic information for each metropolitan area is from CensusReporter.org, DataUSA.io, and the U.S. Bureau of Labor Statistic

1. Cleveland

As one of the largest industrial markets in the US, Cleveland offers unparalleled opportunities for industrial warehouse investment with a strategic infrastructure that attracts logistics and manufacturing businesses, ensuring stable demand for industrial spaces. In Q3 2024, the sector decreased to a low 2.6% vacancy rate from 2.8% in the previous quarter, indicating a tightening market. Despite a slight slowdown in leasing activity, the market remains robust, with average asking lease rates experiencing modest increases, reaching $5.68 per square foot in Q3 2024.

Notable transactions, such as the $28.6 million acquisition of a 458,000-square-foot warehouse in the Southeast submarket, underscore the region’s strong investment appeal. Additionally, Cleveland’s strategic location and well-developed infrastructure continue to attract businesses, further enhancing the industrial sector’s growth prospects.

Crexi Intelligence Cleveland Industrial Trends

For Lease (active)

- Asking rent (annual): $4/SF

- Spaces available on Crexi: 122

- Median SqFt: 8,250

- Days on market: 167

For Sale (active)

- Asking sale price (median): $1.1 million

- Price/SqFt: $50

- Asking cap rate: 8.6%

- Total listings: 45

- Days on market: 145

Sales Comps (past 12 months)

- Median sales price (last 1 year): $165,000

- Sold price /SqFt: $32

- Total sales volume: $145.4 million

- Days on market: 83

2. Jacksonville

Jacksonville, Florida, is an attractive market for industrial property investment in 2025, driven by its strategic location, robust economic growth, and expanding infrastructure. The city's population has surged, adding over 14,000 residents between July 2022 and July 2023, making it the tenth-largest city in the U.S. This demographic growth fuels demand for industrial spaces, particularly in the logistics and manufacturing sectors.

Jacksonville remains one of the fastest-growing industrial real estate markets, thanks to its booming logistics sector. Port expansions to the SSA Terminal are set to nearly double its capacity by mid-2025 and boost industrial demand significantly. In Q3 2024, the industrial vacancy rate rose slightly to 6.1% due the aforementioned new supply, yet stable rental rates reflect a resilient market. Additionally, Jacksonville's private sector employment increased by 1.9% annually as of September 2024, indicating a strong job market that supports industrial growth.

Crexi Intelligence Jacksonville Industrial Trends

For Lease (active)

- Asking rent (annual): $13/SF

- Spaces available on Crexi: 243

- Median SqFt: 27,500

- Days on market: 271

For Sale (active)

- Asking sale price (median): $1.1 million

- Price/SqFt: $111

- Asking cap rate: 6.2%

- Total listings: 54

- Days on market: 183

Sales Comps (past 12 months)

- Median sales price (last 1 year): $800,000

- Sold price /SqFt: $91

- Sold cap rate: 7.8%

- Total sales volume: $511.3 million

- Days on market: 183

3. Houston

Houston continues to rank among the top industrial real estate markets in the U.S., driven by its thriving logistics sector and record-breaking activity at the Port of Houston.

In Q3 2024, the Houston industrial market recorded a net absorption of nearly 6.2 million square feet, bringing the year-to-date total to 16.3 million square feet—a 4% increase over the previous year. This strong demand is complemented by the Port of Houston’s performance, which saw a 20% year-over-year increase in twenty-foot equivalent units (TEUs), reaching 367,653 TEUs, indicating a thriving logistics sector. The construction pipeline, though contracting due to capital conditions, remains active with 11.1 million square feet underway, suggesting a balanced supply-demand dynamic.

These factors contribute to consistent demand for industrial warehouses and new development opportunities.

Crexi Intelligence Houston Industrial Trends

For Lease (active)

- Asking rent (annual): $11/SF

- Spaces available on Crexi: 882

- Median SqFt: 7,499

- Days on market: 183

For Sale (active)

- Asking sale price (median): $1.7 million

- Price/SqFt: $141

- Asking cap rate: 7.0%

- Total listings: 296

- Days on market: 178

Sales Comps (past 12 months)

- Median sales price (last 1 year): $614,100

- Sold price /SqFt: $94

- Sold cap rate: 7.2%

- Total sales volume: $84.1 billion

- Days on market: 174

4. Inland Empire, CA

As one of the largest industrial markets in the U.S., the Inland Empire remains a pivotal hub for industrial warehouse investments. The region’s affordability and proximity to major ports drive strong demand for logistics and supply chain facilities.

In Q3 2024, the region experienced a 70% increase in new leasing activity for properties between 250,000 and 499,999 square feet, indicating strong demand in this segment. Despite a slight uptick in vacancy rates to 7.9%, the market remains resilient, with landlords adjusting asking rates to stimulate activity.

More recently, the San Pedro Bay port complex reported a 22.5% year-to-date increase in loaded imports through August 2024, underscoring the region’s increasing role in logistics and supply chain operations. Additionally, the Inland Empire’s affordability relative to coastal areas has spurred population growth, further enhancing its appeal for industrial development. These factors collectively position the Inland Empire as a strategic and attractive market for industrial property investment in the coming year.

Crexi Intelligence Inland Empire Industrial Trends

For Lease (active)

- Asking rent (monthly): $1/SF

- Spaces available on Crexi: 500

- Median SqFt: 8,281

- Days on market: 159

For Sale (active)

- Asking sale price (median): $2.5 million

- Price/SqFt: $302

- Asking cap rate: 3.9%

- Total listings: 160

- Days on market: 165

Sales Comps (past 12 months)

- Median sales price (last 1 year): $1.2 million

- Sold price /SqFt: $212

- Sold cap rate: 6.8%

- Total sales volume: $1.7billion

- Days on market: 151

5. Orlando

Orlando’s industrial real estate market is a key player in the future of industrial real estate, with over 30% of its 4.3 million square feet of new construction in Q3 2024 pre-leased. The city’s industrial market is attracting increased investor attention, thanks to robust economic growth and a dynamic real estate market. In Q3 2024, the industrial vacancy rate stood at 8.1%, reflecting a 290 basis point increase year-over-year, yet demand remains strong.

The region’s population and GDP growth further support demand for industrial warehouse investments. The Orlando-Kissimmee-Sanford MSA continues to exhibit economic resilience, with GDP growth fueled by employment expansion and steady population increases.

Crexi Intelligence Orlando Industrial Trends

For Lease (active)

- Asking rent (annual): $16/SF

- Spaces available on Crexi: 196

- Median SqFt: 5,759

- Days on market: 179

For Sale (active)

- Asking sale price (median): $3 million

- Price/SqFt: $222

- Asking cap rate: 6.4%

- Total listings: 31

- Days on market: 96

Sales Comps (past 12 months)

- Median sales price (last 1 year): $2 million

- Sold price /SqFt: $183

- Sold cap rate: 8.6%

- Total sales volume: $275.1 million

- Days on market: 126

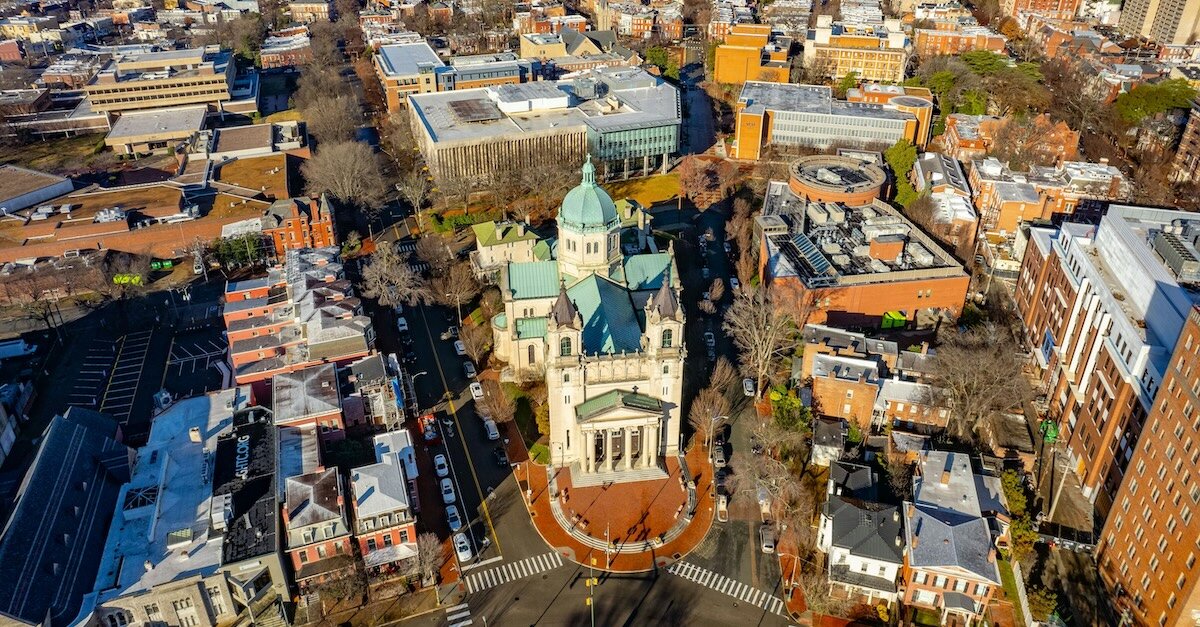

6. Richmond

With its expanding infrastructure and growing population, Richmond is considered one of the emerging markets for industrial real estate in 2025. In Q3 2024, the market recorded approximately 1.9 million square feet of leasing across 28 transactions, marking the highest quarterly volume since early 2023. This surge in demand contributed to a decrease in the overall vacancy rate, which fell by 30 basis points quarter-over-quarter, settling at 3.4%.

Additionally, the average asking rent for warehouse space remained elevated at $7.71 per square foot per annum on a triple net basis, reflecting the market’s strong fundamentals. The region’s strategic location, within a 48-hour drive of 75% of the U.S. population, enhances its appeal as a distribution hub.

Crexi Intelligence Richmond Industrial Trends

For Lease (active)

- Asking rent (annual): $8/SF

- Spaces available on Crexi: 21

- Median SqFt: 12,000

- Days on market: 86

For Sale (active)

- Asking sale price (median): $1.8 million

- Price/SqFt: $189

- Asking cap rate: 6.3%

- Total listings: 12

- Days on market: 204

Sales Comps (past 12 months)

- Median sales price (last 1 year): $750,000

- Sold price /SqFt: $93

- Total sales volume: $54.5 million

- Days on market: 98

7. Las Vegas

Las Vegas’s industrial growth cements its position among the top warehouse real estate markets, supported by new construction and leasing activity. The city had nearly 4 million square feet of new construction delivered in Q1 2024, positioning the market to surpass 16 million square feet of new industrial space by year-end—a record high and more than double the recent five-year average. This surge in supply has led to a vacancy rate increase from 3.3% at the end of 2023 to 4.9% in Q1 2024.

Despite the vacancy rise, tenant demand remains robust, with 2.8 million square feet of leasing activity and 1.6 million square feet of net absorption recorded in Q1 2024. Asking rents have plateaued at $1.11 per square foot per month, with rent growth slowing to 3.5% in Q3 2024, down from 6.5% in Q2, due to increased supply and heightened competition among landlords. The market's expansion is further supported by Las Vegas's strategic location and favorable business climate, attracting industrial tenants from adjacent markets and the surrounding region.

Crexi Intelligence Las Vegas Industrial Trends

For Lease (active)

- Asking rent (annual): $15/SF

- Spaces available on Crexi: 348

- Median SqFt: 6,554

- Days on market: 132

For Sale (active)

- Asking sale price (median): $3.9 million

- Price/SqFt: $277

- Asking cap rate: 4.2%

- Total listings: 73

- Days on market: 127

Sales Comps (past 12 months)

- Median sales price (last 1 year): $2.2 million

- Sold price /SqFt: $216

- Total sales volume: $36.7 million

- Days on market: 597

8. Louisville

Louisville’s industrial real estate market is experiencing robust growth, with Q3 2024 recording approximately 1.8 million square feet of positive net absorption, reducing the vacancy rate by 90 basis points to 3.4%.

This strong demand is further evidenced by significant leasing activity, totaling 1,377,082 square feet in the same quarter. The market's appeal benefits from Louisville's strategic location, providing access to 75% of the U.S. population within a day's drive, making it a vital logistics hub. Louisville's industrial sector also benefits from a favorable business climate and ongoing infrastructure improvements, supporting sustained growth and investment potential.

Crexi Intelligence Louisville Industrial Trends

For Lease (active)

- Asking rent (annual): $8/SF

- Spaces available on Crexi: 95

- Median SqFt: 11,400

- Days on market: 178

For Sale (active)

- Asking sale price (median): $1.5 million

- Price/SqFt: $70

- Total listings: 32

- Days on market: 137

Sales Comps (past 12 months)

- Median sales price (last 1 year): $550,000

- Sold price /SqFt: $67

- Sold cap rate: 4.6%

- Total sales volume: $31 million

- Days on market: 124

9. Philadelphia

Philadelphia’s industrial real estate market is exhibiting strong fundamentals, with the average overall vacancy rate decreasing by 60 basis points quarter-over-quarter to 8.6% in Q3 2024. This decline in vacancy is accompanied by a significant uptick in leasing activity, particularly from third-party logistics providers, which continue to dominate the bulk of leasing transactions.

Additionally, the market has absorbed over one million square feet in Q3 2024, indicating robust demand for industrial space. Despite the increase in supply, rental rates have remained stable, reflecting the market’s resilience and sustained interest from investors. Philadelphia’s strategic location along the I-95 corridor enhances its appeal as a logistics hub, providing access to major East Coast markets.

Crexi Intelligence Philadelphia Industrial Trends

For Lease (active)

- Asking rent (annual): $12/SF

- Spaces available on Crexi: 120

- Median SqFt: 11,000

- Days on market: 284

For Sale (active)

- Asking sale price (median): $1.4 million

- Price/SqFt: $106

- Asking cap rate: 8.9%

- Total listings: 76

- Days on market: 278

Sales Comps (past 12 months)

- Median sales price (last 1 year): $795,000

- Sold price /SqFt: $91

- Total sales volume: $396.4 million

- Days on market: 119

10. Denver

Denver’s strong leasing performance highlights ongoing industrial property demand trends, with total leasing volume surpassing 3.6 million square feet in Q3 2024—a 38.1% increase from the previous quarter and a 59.9% rise compared to last year. This heightened demand has contributed to a decrease in the direct vacancy rate, which fell by 10 basis points quarter-over-quarter to 7.7%, while total availability declined by 20 basis points to 9.1%.

Average asking rents have also grown, reaching $9.60 per square foot, a 1.5% increase from the previous quarter and a 6.8% year-over-year rise. The construction pipeline remains robust, with 24 buildings totaling 3.9 million square feet under development, indicating sustained investor confidence in the market's future prospects.

Crexi Intelligence Denver Industrial Trends

For Lease (active)

- Asking rent (annual): $19/SF

- Spaces available on Crexi: 1,038

- Median SqFt: 2,401

- Days on market: 246

For Sale (active)

- Asking sale price (median): $1.5 million

- Price/SqFt: $263

- Asking cap rate: 6.2%

- Total listings: 217

- Days on market: 167

Sales Comps (past 12 months)

- Median sales price: $682,300

- Sold price /SqFt: $154

- Sold cap rate: 6.1%

- Total sales volume: $281.6 million

- Days on market: 110

As we move into 2025, identifying the best industrial property investments for 2025 becomes crucial for those looking to capitalize on market shifts. Emerging industrial real estate trends for 2025, like the growing preference for eco-friendly buildings, are shaping demand across regions. From Richmond’s strategic logistics to Denver’s high absorption rates, this cities list highlights some of the top industrial property investments for the year ahead.

Get more retail property data at your fingertips with Crexi Intelligence.