The Charlotte Commercial Real Estate Market

August 15, 2025

Key Takeaways

- Charlotte’s rapid population and job growth, paired with its diverse economy, are fueling demand across office, industrial, retail, and multifamily sectors.

- The city’s pro-business environment, young workforce, and strong infrastructure continue to attract Fortune 500 companies, startups, and investors alike.

- Market activity remains strong across asset classes, with industrial leasing and retail demand leading, while office and multifamily sectors adjust to supply and absorption trends.

- Crexi provides brokers, investors, and tenants with tools to track real-time listings, analyze comps, and connect with opportunities across the Charlotte-Concord-Gastonia region.

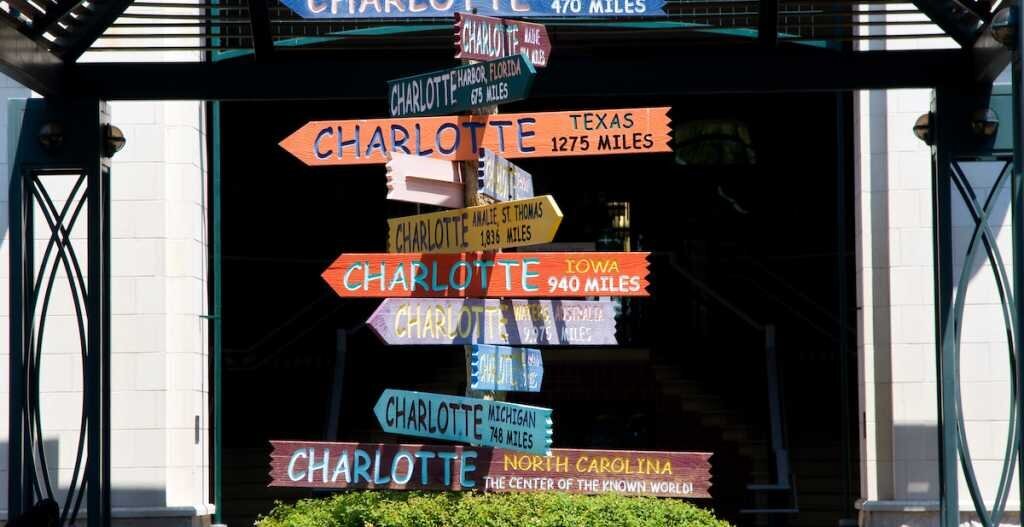

Charlotte continues to make a name for itself as one of the Southeast’s most active commercial real estate markets. With a strong economy, steady population growth, and a business-friendly environment, it’s no surprise that both investors and tenants are keeping a close eye on the Queen City. From established institutions to up-and-coming startups, businesses are expanding across the region.

For brokers, buyers, and tenants, Crexi provides the tools to navigate Charlotte’s evolving CRE landscape with confidence. Our platform hosts thousands of properties across the Charlotte-Concord-Gastonia MSA, making it easier to search, narrow options, and connect with local brokers in just a few clicks. And for listing agents, Crexi’s streamlined marketing and lead management tools help close deals faster and more efficiently. To date, Crexi has facilitated over $1 trillion in transactions, 8.6 billion square feet leased, and supports a growing community of more than 2 million monthly active users.

Crexi proudly supports professionals across Charlotte, Gastonia, Concord, Mooresville, Matthews, and throughout Mecklenburg County, serving as the region’s fastest-growing digital commercial real estate marketplace.

The State of Commercial Real Estate in Charlotte

As the largest city in North Carolina, Charlotte sits at the crossroads of economic growth, cultural energy, and strategic development. With a strong economic foundation in finance and banking, and growing momentum in technology, healthcare, and logistics, the city’s commercial footprint continues to expand across sectors.

Charlotte’s skyline reflects both its ambition and diversity - towering office buildings in Uptown, innovative mixed-use projects in South End, and steady industrial development on the city's edges. New construction continues to dot the map, with investments in retail, office, multifamily, and industrial properties reshaping neighborhoods and adding density.

Areas like SouthPark and NoDa remain popular with businesses seeking creative space and community access, while regional corridors like I-77 and I-85 continue to attract logistics and distribution users. In short: Charlotte isn’t just growing, it’s evolving in every direction and offering opportunities for nearly every asset type and investment strategy.

Charlotte Regional Breakdown

Charlotte’s steady growth shows no sign of slowing down, as the region attracts new residents with its strong economy, relatively low cost of living, and high quality of life. City initiatives like the Capital Investment Plan continue to support this growth, helping expand infrastructure and public services to meet rising demand. With a younger population and steady income growth, Charlotte is proving to be a city that's growing with intention.

- Charlotte is the county seat of Mecklenburg County and the most populous city in North Carolina.

- Over 911,000 people live in Charlotte, with more than 2.8 million residents in the Charlotte-Concord-Gastonia, NC-SC metropolitan area.

- Charlotte is the nation’s 7th fastest-growing large metro area.

- Since 2020, the city’s population has grown by 20%, according to a report from the Charlotte Regional Business Alliance.

- The median age in Charlotte is 34.7, which is about 10% younger than the figures for both the larger metro area and the state.

- Charlotte’s per capita income is $50,510 and the median household income is $80,581 - and with a cost of living that is lower than the national average, residents can enjoy a high quality of life.

Charlotte Job Market

Charlotte continues to outperform as a regional economic powerhouse, thanks to its pro-business climate, educated workforce, and strategic location. A deep talent pool, fueled by dozens of universities, feeds key industries like finance, tech, life sciences, and advanced manufacturing. Add in top-tier infrastructure and a growing cluster of Fortune-ranked companies, and it’s easy to see why Charlotte is a magnet for investment, innovation, and long-term growth.

- The total GDP for Charlotte-Concord-Gastonia NC-SC MSA is nearly $256 billion, according to the most recent report by the St. Louis Fed.

- Target industries include advanced manufacturing, financial services, technology and IT services, life sciences, and logistics and distribution.

- The unemployment rate is 4%, with an employed population of more than 1.4 million in the metropolitan area, based on data from the US Bureau of Labor Statistics (August 2025).

- There are three dozen universities and community colleges in the area, offering a combined 27,000 different degrees and certification programs.

- The Charlotte region is home to 19 companies ranked on the Fortune 500/1000 list, including Bank of America, Lowe’s, Honeywell, Nucor, Duke Energy, Truist, and Sonic Automotive.

- The Charlotte area is home to prominent educational institutions such as the University of North Carolina at Charlotte, Queens University of Charlotte, and Johnson C. Smith University, contributing to the region’s academic and research capabilities.

- More than 50% of Charlotte residents hold a bachelor’s or post-graduate degree, a rate about 1.4 times higher than that in North Carolina overall.

- Charlotte boasts a well-developed transportation infrastructure, with major interstates like I-77 and I-85, providing easy access to other major metros such as Atlanta and Washington, DC, and proximity to ports in Wilmington and Charleston.

- The city is also home to the bustling Charlotte Douglas International Airport (CLT), with extensive domestic and international flights.

Charlotte Industrial Market

Charlotte’s industrial market is finding its rhythm once again. After several quarters of aggressive development, vacancy is starting to ease as more tenants move in and get to work. Submarkets like Gaston County are seeing strong leasing activity, while developers are shifting to a more measured pace, focusing on right-sized projects that match current demand. The result is a market moving toward long-term stability, without losing momentum.

Market overview (Cushman & Wakefield Q2 2025)

- Inventory: 314, SF

- Vacancy rate: 8.4%

- Net absorption: 2,620,414 SF (YTD)

- Deliveries: 2,933,035 SF (YTD)

- Under construction: 4,025,479 SF

- Key leases by tenant: MAT Holdings (511,661 SF), Corsan Logistics (335,812 SF), Britax Child Safety, Inc (257,920 SF)

- Largest submarkets: Southwest, North, York County, Gaston County

Crexi Insights

These are the most recent lease and sales trends from Crexi Insights (as of August 2025):

For Lease (active)

- Asking rate/SqFt (median): $14 per year

- Median SqFt/listing: 12,800

- Days on market: 161

- Total listings on Crexi: 303 spaces

For Sale (active)

- Median asking price: $2.8 million

- Price/SqFt: $223

- Asking cap rate: 7%

- Days on market: 133

- Total listings on Crexi: 50

Sales Comps (past 12 months)

- Median sold price: $1.5 million

- Sold price/SqFt: $184

- Total sales volume: $488 million

- Sold cap rate: 7.7%

- Median SqFt sold/transaction: 12,500

- Total SqFt sold: 3.7 million

- Days on market (median): 193

Charlotte Office Market

The Charlotte office market is working through some growing pains, but all signs are pointing to a strong recovery. Vacancy remains elevated, but tenant activity is steady, especially in Class A buildings across Uptown, Midtown, and the Airport corridor. With no new construction underway for the first time in decades, the focus has shifted to absorbing existing supply. As top-tier space gets leased, demand could trickle down to well-located Class B buildings, especially those promising upgraded amenities.

Market overview (Cushman & Wakefield Q2 2025)

- Inventory: 56,967,188 SF

- Vacancy rate: 26.1%

- Net absorption: -396,455 SF (YTD)

- Leasing activity: 1,148,702 SF (YTD)

- Under construction: 0 SF

- Key leases by tenant: Trimont (67,935 SF), Coinbase (58,628 SF), Pike Electric Corporation (50,881 SF)

- Largest submarkets: Uptown/CBD, Airport, South/485/Ballantyne

Crexi Insights

For the latest updates on the office market in Charlotte, turn to Crexi Insights. Here is the detailed information on recent sales and leasing trends as of August 2025:

For Lease (active)

- Asking rate/SqFt (median): $29 per year

- Median SqFt/listing: 2,319 SF

- Days on market: 211

- Total listings on Crexi: 826 spaces

For Sale (active)

- Median asking price: $1.7 million

- Price/SqFt: $420

- Asking cap rate: 6.4%

- Days on market: 144

- Total listings on Crexi: 73

Sales Comps (past 12 months)

- Median sold price: $947,500

- Sold price/SqFt: $303

- Total sales volume: $645.2 million

- Sold cap rate: 6.3%

- Median SqFt sold/transaction: 2,000 SF

- Days on market (median): 269

Charlotte Retail Market

Charlotte’s retail market remains tight, with vacancy hovering near record lows and small-format space in especially high demand. Tenants are moving quickly to claim available square footage, particularly in high-growth southern submarkets where foot traffic and mixed-use density are strongest. With construction activity ticking upward, largely driven by grocery-anchored developments, the market continues to lean in favor of landlords, especially in lifestyle-focused corridors.

Market overview (Colliers Q2 2025)

- Inventory: 135,300,000 SF

- Vacancy rate: 2.8%

- Net absorption: 287,475 SF (YTD)

- Under construction: 532,878 SF

- Top lease transactions by tenant: Carbon Performance (43,800 SF), The Casey - Expansion (13,100 SF), Las Americas (12,400 SF)

- Top sale transactions by property: Gold Hill Commerce Park ($4.7 million), Carmel Village ($19.1 million)

Crexi Insights

Here are the latest Charlotte retail market lease and sales trends from Crexi Insights (as of August 2025):

For Lease (active)

- Asking rate/SqFt (median): $28 per year

- Median SqFt/listing: 2,458 SF

- Days on market: 268

- Total listings on Crexi: 400 spaces

For Sale (active)

- Median asking price: $2.2 million

- Price/SqFt: $460

- Asking cap rate: 6.2%

- Days on market: 141

- Total listings on Crexi: 97

Sales Comps (past 12 months)

- Median sold price: $1.9 million

- Sold price/SqFt: $335

- Total sales volume: $375 million

- Sold cap rate: 6.6%

- Median SqFt sold/transaction: 3,588 SF

- Days on market (median): 175

Charlotte Multifamily Market

The multifamily market in Charlotte continues to walk a tightrope between strong renter demand and an active development pipeline. While leasing velocity has picked up, a steady stream of new deliveries is keeping vacancy elevated and rent growth relatively flat. Still, investor interest remains steady, with recent transactions pointing to confidence in the market’s long-term fundamentals, especially in high-growth submarkets like South Charlotte and Iredell County.

Market overview (Northmarq Q1 2025 Multifamily Market Insights Report)

- Total housing units: 1,190,505

- Vacancy rate: 8.0%

- Average asking rent: $1,593

- Annual rent growth: 1.1% (YTD)

- Units delivered: 4,233 (YTD)

- Under construction: 24,160 units

- Recent transactions: NOVEL Ballantyne (285 units), Axis Berewick (266 units), Westhall (150 units)

Crexi Insights

Here are the most recent Charlotte multifamily market insights from Crexi (as of August 2025):

For Sale (active)

- Median asking price: $1.3 million

- Asking cap rate: 5.3%

- Days on market: 99

- Total listings on Crexi: 21

Sales Comps (past 12 months)

- Median sold price: $350,000

- Sold price/SqFt: $220

- Total sales volume: $1.2 billion

- Sold cap rate: 5.6%

- Total SqFt sold: 501 million

- Days on market (median): 818

Get more in-depth Charlotte market data with Crexi Intelligence.