Who Pays Closing Costs in Commercial Real Estate?

Learn

Closing costs are an important but sometimes overlooked part of commercial real estate (CRE) transactions, covering the fees and expenses needed to officially transfer ownership and finalize financing. While both buyers and sellers typically incur some portion of the expense, who covers which fees can vary based on negotiations, deal structure, and market conditions.

This guide breaks down common commercial closing costs, explains who typically pays what, and offers practical planning tips for both sides of the deal.

What are Closing Costs in Commercial Real Estate?

Commercial real estate closing costs encompass a wide range of legal, financial, and third-party service fees required to finalize the sale. These costs can range from 2% to 5% of the transaction value, but depending on the specific deal, they can be even higher.

Unlike residential transactions where certain conventions are well-established, commercial closing cost structures tend to be more flexible and heavily negotiated. Commercial deals often involve larger sums of money, more complex due diligence, and broader legal and financial services, all of which impact the final bill.

Common Commercial Real Estate Closing Costs

When it comes to commercial real estate deals, closing costs can span a wide range of services and fees. Knowing which expenses are involved—and who usually covers them—helps both buyers and sellers avoid surprises at closing.

Below, we break down the most common types of closing costs in CRE and how they typically come into play during a transaction.

Title & Due Diligence Fees

- Title search and title insurance: Typically paid by the buyer to ensure the property has clear ownership and no outstanding liens.

- Environmental reports: Buyers usually pay for environmental site assessments to uncover any contamination risks.

- Property surveys: Costs are often borne by the buyer, but sometimes they are split between both parties.

- Legal review: Each party usually pays for their own attorney to review contracts, leases, and transaction documents.

Financing & Loan-Related Costs

- Appraisal: Generally paid for by the buyer as part of the loan underwriting process.

- Underwriting and processing fees: Buyers are responsible for lender-related fees to process and approve their loans.

- Origination points: If applicable, these upfront loan fees are paid by the buyer.

- Lender’s legal fees: Buyers are typically responsible for both their attorney and the lender’s legal fees.

Transfer & Government Fees

- Transfer taxes: Local law often dictates whether the buyer or seller pays; in many areas, the seller covers these.

- Recording fees: Typically paid by the buyer to record the deed and mortgage documents with the local government.

- Prorated property taxes: Usually split between buyer and seller based on the closing date.

Broker & Marketing Fees

- Broker commissions: Generally paid by the seller and often already factored into the listing agreement.

- Marketing expenses: Sellers typically cover any property marketing costs prior to sale.

Repairs & Escrow Accounts

- Repairs: If needed, repairs may be negotiated during due diligence. Sellers often credit the buyer at closing or complete repairs themselves.

- Escrow setup and prepaid insurance/taxes: Buyers are responsible for setting up escrow accounts if required by lenders and prepaying certain expenses.

Who Typically Pays What?

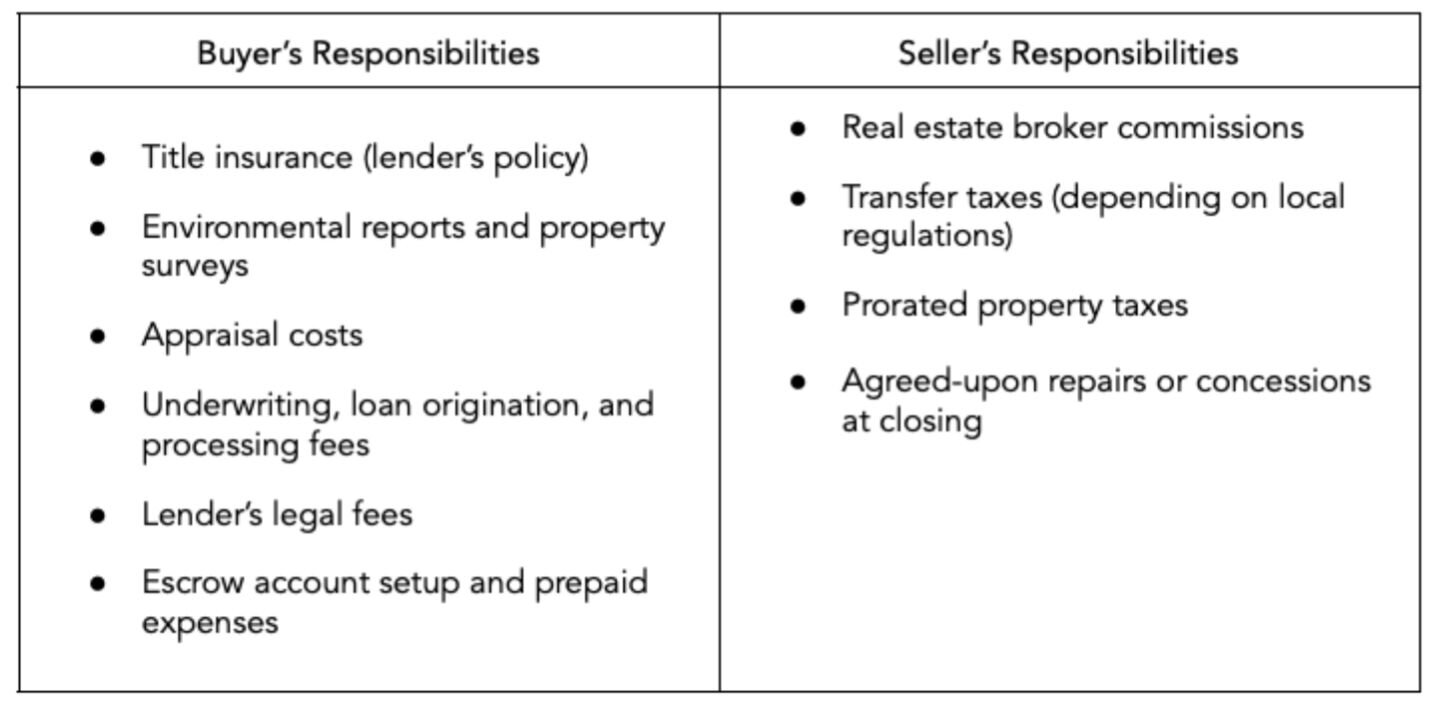

In most commercial real estate transactions, certain closing costs are traditionally assigned to either the buyer or the seller. However, it’s important to understand that these allocations aren’t set in stone. Closing costs are often negotiable and can shift depending on factors like market conditions, the relative leverage of each party, and the complexity of the deal.

Here’s a general breakdown of which closing costs are typically handled by buyers vs. sellers:

How Closing Costs Are Negotiated in CRE

CRE closing costs are often a point of negotiation just like price, lease terms, or contingencies. In a strong buyer’s market, buyers may have more leverage to request that sellers cover a larger share of closing costs, such as transfer taxes, certain legal fees, or even a credit toward financing expenses. Conversely, in a seller’s market, sellers typically pass more of the closing cost burden onto buyers.

Sellers may offer to cover part of the buyer’s closing costs to keep a deal on track, especially if issues arise during due diligence or financing. Closing costs can also be used as a negotiation lever to bridge small gaps in sale price expectations without changing the headline purchase price. In smaller, private deals, there's often more flexibility in how costs are divided, while in institutional transactions, cost allocations tend to follow stricter, market-standard expectations laid out in formal agreements.

Understanding when and how to negotiate closing costs in commercial real estate can add real value to a deal - and end up benefiting both the buyer and seller.

Tips to Plan and Budget for Commercial Closing Costs

Closing costs can add up quickly, so it’s smart to plan for them well before reaching the closing table. A few practical tips can help buyers and sellers budget effectively and avoid surprises:

- Start by getting a preliminary estimate early. Before making or accepting an offer, ask your broker, attorney, or lender for a ballpark estimate of expected closing costs based on deal size, financing terms, and local tax rates.

- Confirm lender fee breakdowns upfront. If financing is involved, request a detailed list of all lender-related fees early in the loan application process. Origination points, underwriting fees, appraisal costs, legal charges, and processing fees can vary widely between lenders, so understanding these costs upfront can help you compare financing options more effectively.

- Use experienced legal counsel to review cost allocations. An experienced attorney can help make sure cost responsibilities are clearly spelled out—and prevent any last-minute surprises buried in the fine print.

- Budget for escrow funding and reserves. Buyers should be prepared to fund escrow accounts for insurance premiums, property taxes, and sometimes operating reserves at closing. These upfront cash requirements can add significantly to your total out-of-pocket costs, so be sure to factor them into your planning.

- Expect (and plan for) negotiation adjustments. During due diligence, new issues - like needed repairs or survey discrepancies - may arise that affect final closing costs. Keep some flexibility in your budget to allow for negotiated credits, price adjustments, or last-minute repairs that shift cost responsibility.

- Understand timing differences for prorated items. Closing costs often include prorated property taxes, rent, utilities, or association fees. Make sure you understand how these are calculated based on the closing date, and budget accordingly so you aren’t caught off guard by higher-than-expected prorated amounts.

- Work with professionals who know the local market. Closing cost norms vary not just by state, but sometimes even by county or city. Working with a broker, lender, and attorney familiar with the local market ensures that your closing cost expectations are realistic for your location and deal type.

- Don’t overlook post-closing costs. You’ll still need cash on hand for repairs, vacancies, or capital improvements once the deal is done. Make sure you retain sufficient cash reserves after closing to cover unexpected property repairs, vacancies, delayed rental income, or capital improvements. Underestimating post-closing liquidity can strain operations and delay return on investment.

Why Understanding Closing Costs Matters for CRE Buyers and Sellers

Closing costs aren’t just an afterthought; they can significantly impact your bottom line. For buyers, underestimating closing costs could strain liquidity post-closing. For sellers, unexpected fees could erode net proceeds.

By understanding how closing costs are structured, negotiated, and allocated, both parties can approach transactions more strategically - and avoid last-minute surprises. Transparency, early planning, and experienced advisors make all the difference.

Ready to take the next step in your real estate journey? Be sure to consult with a broker, lender, or attorney familiar with local CRE transactions - and when you’re ready, Crexi’s Intelligence data can help you make smarter decisions at every stage of the deal.