Commercial Lease Structures: Net Lease, Gross Lease, and Modified Gross Lease

Navigating a commercial lease can be overwhelming, especially when faced with dozens of pages full of confusing legal jargon. However, understanding commercial lease types is critical for business owners, investors, and landlords alike - especially because the right commercial lease structure can impact everything from daily operation costs to long-term profitability.

Commercial Lease Types & Why They Matter

The different types of commercial leases determine who pays for key expenses like maintenance, taxes, and utilities, directly affecting operating costs and long-term profitability. Knowing the basics of these lease types empowers you to negotiate better terms and ensure the lease aligns with your financial goals.

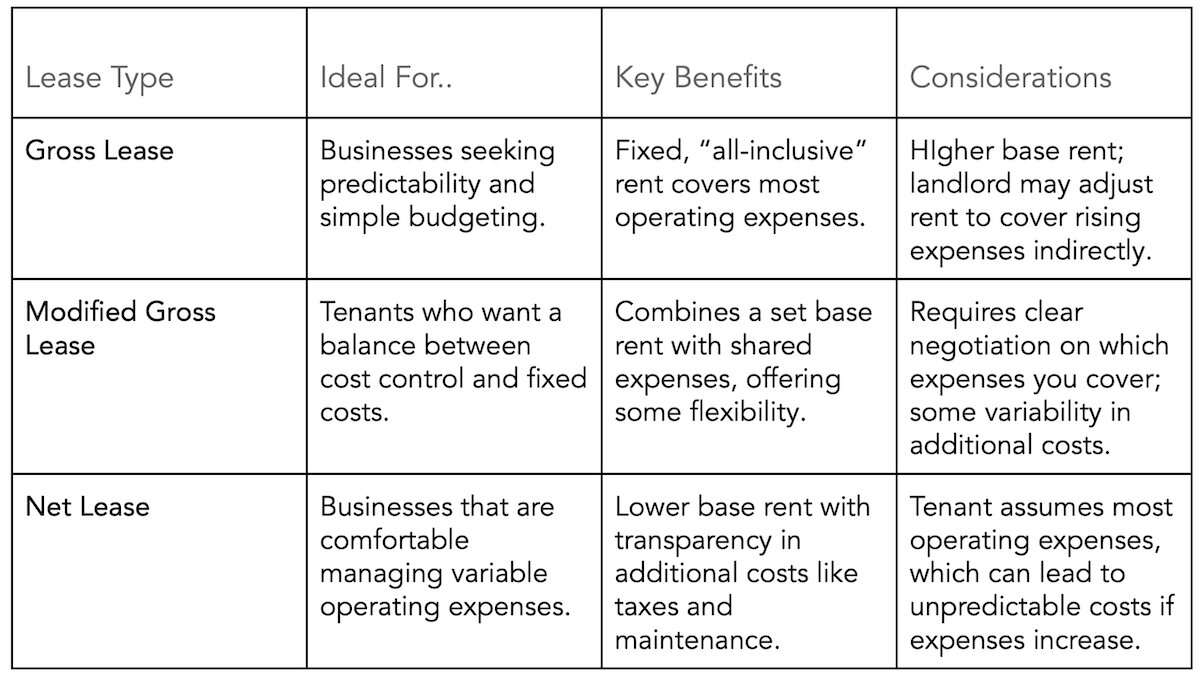

The 3 Types of Commercial Lease Structures

Each type of commercial lease structure has its own set of benefits and challenges, but with the right information, you can choose an option that fits your budget and supports your business strategy.

Net Lease

A net lease requires tenants to pay base rent plus additional property-related expenses. Depending on the lease type, this can include:

- Single Net Lease (N): Tenant pays base rent plus property taxes.

- Double Net Lease (NN): Tenant covers base rent, property taxes, and insurance.

- Triple Net Lease (NNN): Tenant is responsible for base rent, property taxes, insurance, and maintenance.

Here’s an example of how a net lease structure might look in the real world:

A retail store leases 5,000 sq. ft. under an NNN lease at $20 per sq. ft. annually.

- Base Rent: $100,000/year

- Property Tax: $5,000/year

- Insurance: $3,000/year

- Maintenance: $7,000/year

- Total Annual Cost: $115,000/year

Benefits of a Net Lease

- Lower base rent compared to other lease structures.

- Operating costs are passed directly to the tenant, which can offer more predictability for landlords.

Drawbacks of a Net Lease

- Tenants bear the risk of fluctuating operating expenses.

- Total cost can be less predictable due to rising property taxes or maintenance fees.

Gross Lease

In a gross lease, the tenant pays one fixed rent, and the landlord covers most operating expenses such as property taxes, insurance, maintenance, and utilities.

For example, let’s imagine a law firm leases a 2,500 sq. ft. office at $30 per sq. ft. annually under a Gross Lease.

- Total Annual Rent: $75,000, with no additional costs beyond the fixed payment.

Benefits of a Gross Lease

- Simplifies budgeting with a predictable monthly payment.

- Tenants avoid unexpected costs related to property expenses.

Drawbacks of a Gross Lease

- Typically comes with a higher base rent.

- Landlords might indirectly pass along cost increases through rent adjustments.

Modified Gross Lease

A modified gross lease is a hybrid arrangement where the tenant pays a base rent and takes on some additional costs (often utilities or janitorial services) while the landlord covers other operating expenses.

In practice, this is what a modified gross lease would look like:

A startup leases 3,000 sq. ft. at $18 per sq. ft. under a Modified Gross Lease, where the tenant also pays for utilities.

- Base Rent: $54,000/year

- Utilities: $5,000/year

- Total Lease Cost: $59,000/year

Benefits of a Modified Gross Lease

- Offers more flexibility compared to a full gross lease.

- Can lower overall costs if tenants manage the additional expenses efficiently.

Drawbacks of a Modified Gross Lease

- More variables mean potential cost fluctuations.

- Requires clear negotiation on which expenses are the tenant’s responsibility.

Regional Differences in Lease Terminology

Keep in mind that definitions for commercial lease types may vary by region and market custom. For example, in one area, it might be standard to exclude electric bills from a gross lease - yet still call it “gross” - while in another, the same arrangement might be considered a modified gross lease.

This makes it extremely important for leasing brokers and tenants to verify exactly what expenses are included in the rental rate, regardless of the terms used.

Which Commercial Lease Structure is Right for You?

Choosing the right commercial lease can make a big difference in your business’s day-to-day operations and future success, and it's important to match your lease structure to your unique needs.

Key Lease Terms to Consider Before Signing a Commercial Lease

Before finalizing your lease, it’s crucial to understand the key terms that can affect your costs and flexibility over the life of the agreement. Here are a few important elements to keep in mind:

- Lease Duration & Renewal Options: Consider the length of the lease and whether renewal options are available. A longer lease might offer stability, while shorter terms provide flexibility.

- Rent Escalation Clauses: Look for provisions detailing how and when rent increases occur. This helps you plan for future costs and budget accordingly.

- Operating Expenses: Clarify which expenses (such as property taxes, insurance, and maintenance) are included in your base rent, and which will be passed on to you as additional charges.

- Tenant Improvements & Build-Out Allowances: Understand what allowances the landlord offers for customizing the space to your needs, and how these improvements affect your overall costs.

- Termination & Subleasing Rights: Review the terms around early termination, assignment, and subleasing. These can provide flexibility if your business needs change.

Final Thoughts

Understanding the nuances of commercial lease structures is a foundational step towards making effective real estate decisions, empowering you to negotiate agreements that align with your business goals and protect your interests.

Ready to take your commercial real estate strategy to the next level? Explore Crexi’s powerful tools and comprehensive market insights to unlock your next commercial lease.