Crexi National CRE Trends Report Q1 2024

Reports

The Crexi Team

May 3, 2024

Crexi’s comprehensive, data-powered information is essential in investor and broker arsenals. Our quarterly overview report aims to provide valuable insights and trends, and shed light on the undercurrents of commercial real estate activity. This report examines CRE activity on Crexi throughout Q1 2024, considering quarterly metrics and year-over-year data, enabling stakeholders to make informed strategic decisions when navigating the potentially complicated waters ahead.

What Happened in Q1 2024?

Lingering inflation may delay rate cuts, despite resilient macroeconomic factors

The U.S. economy has showcased resilience and strength in the face of global uncertainties, with Q1 data underscoring an adapting economic economic playing field. A projected GDP growth of 2.4% for the first quarter reflects a healthy economic environment, and though this metric is down from Q4 2023’s 3.4%, it still represents modest growth.

Strong job reports for February and March, where the latter saw an impressive addition of 303,000 jobs, exceeded expectations, and reduced the unemployment rate to 3.8%. The S&P 500’s best quarter since 2019 and sustained consumer spending – as reported by Visa – signified a high level of consumer confidence and a bullish stock market during the first quarter, bolstered by optimism around artificial intelligence developments and overall healthy corporate profits.

"Transaction data indicates that commercial real estate might have troughed in Q4’23, with activity and pricing (in some instances) increasing in the first quarter of 2024. However, many remain in limbo as macroeconomic volatility has preserved uncertainty and a wide bid-ask spread. Despite the delayed onset of a new cycle, CRE continues to demonstrate resilience and we remain long-term bulls for those with patient capital.” - Eli Randel, COO, Crexi

However, these green flags come with their own challenges, particularly when managing inflation, which has turned out to be a stickier problem than previously thought. The CPI in March rose by 3.5%, up from February’s 3.2%, and positive economic data complicate the Federal Reserve’s task of balancing economic growth with controlling inflation with interest rate adjustments, as they target a 2% inflation goal.

While many economists anticipated interest rate cuts starting in mid-2024, the current economic data and inflationary pressures might lead the Federal Reserve to reconsider or delay the extent and timing of these rate cuts, perhaps even to 2025. However, some economists (but not all) recently stated they believe…

Cost of capital and resulting bid-ask spread limited deployment opportunities

Delayed cuts could affect consumer borrowing, business investment, and overall economic momentum, including investment deployed into the commercial real estate space. Indeed, Deloitte’s latest commercial real estate outlook survey pointed to the cost of capital and capital availability as the most pressing issue among CRE’s sector health.

Facing tightening loan standards, fewer lenders, and higher borrowing costs, commercial real estate buyers could have more difficulty deploying capital for purchases in 2024. However, real estate investors eager to deploy an abundance of capital are leaning on creativity and getting more proactive with financial sourcing partners.

On the one hand, the CMBS market made moves during Q1, with a 39% increase in issuance compared to the previous quarter, and nearly four times as much as Q1 2023’s lending velocity, per Treppwire. On the other hand, as traditional bank financing becomes more hesitant with their balance sheets, alternative methods, such as syndication, joint ventures, or private equity come into play. Many CRE professionals have a clearer understanding of market fluctuations than in 2023 and – even without certainty of rate cuts – are pricing in higher rates as part of their operational costs and finding deals accordingly.

Those facing maturing mortgages are encountering refinancing challenges in this prolonged high-interest environment, particularly in specific segments like office, which has been hit hard by the shift towards remote work. However, banks, keen to avoid marking down loans and realizing losses, have shown flexibility, offering refinancing or restructuring terms more favorable than anticipated.

On a brighter note, the new normal of high construction costs and prolonged project timelines could inadvertently benefit the CRE market by limiting new supply. This constraint may advantage well positioned assets, making them more attractive in the marketplace and potentially enhancing their value over time.

Transaction happenings and actionable opportunities

According to Deloitte, real estate has come a long way from its former classification as an “alternative” investment market, now representing nearly two-thirds of tangible assets globally. We remain bullish that this era is one of the best times to be in commercial real estate, with transformational opportunities to redefine the sector’s fundamentals and unlock return on investment.

Optimizing cash reserves is crucial, and quick access to cash can be a game-changer, enabling investors to seize opportunities swiftly, especially to time acquisitions with potential rate drops. Additionally, the vast and evolving landscape of proptech presents exciting opportunities for CRE owners and investors to enhance their operations and competitive stance and cut costs. Employing technologies such as smart thermostats and digital rent payment systems not only streamlines property management but also bolsters the investment decision-making process.

As we’ll explore below, the CRE market continues to evolve and build on the trends that shaped 2023. Despite some contradictory economic signs and capital-sourcing challenges, early data from Q1 2024 indicates a stable period for the CRE market, with a general optimism about the future.

"Commercial real estate professionals continue to seek digital tools to increase transaction speed, marketing reach, and efficiency. Crexi remains bullish about the long-term success of the commercial real estate sector, and sees now as an exciting time for anyone involved in commercial real estate, from seasoned investors to those just beginning their journey.” - Mike DeGiorgio, COO, Crexi

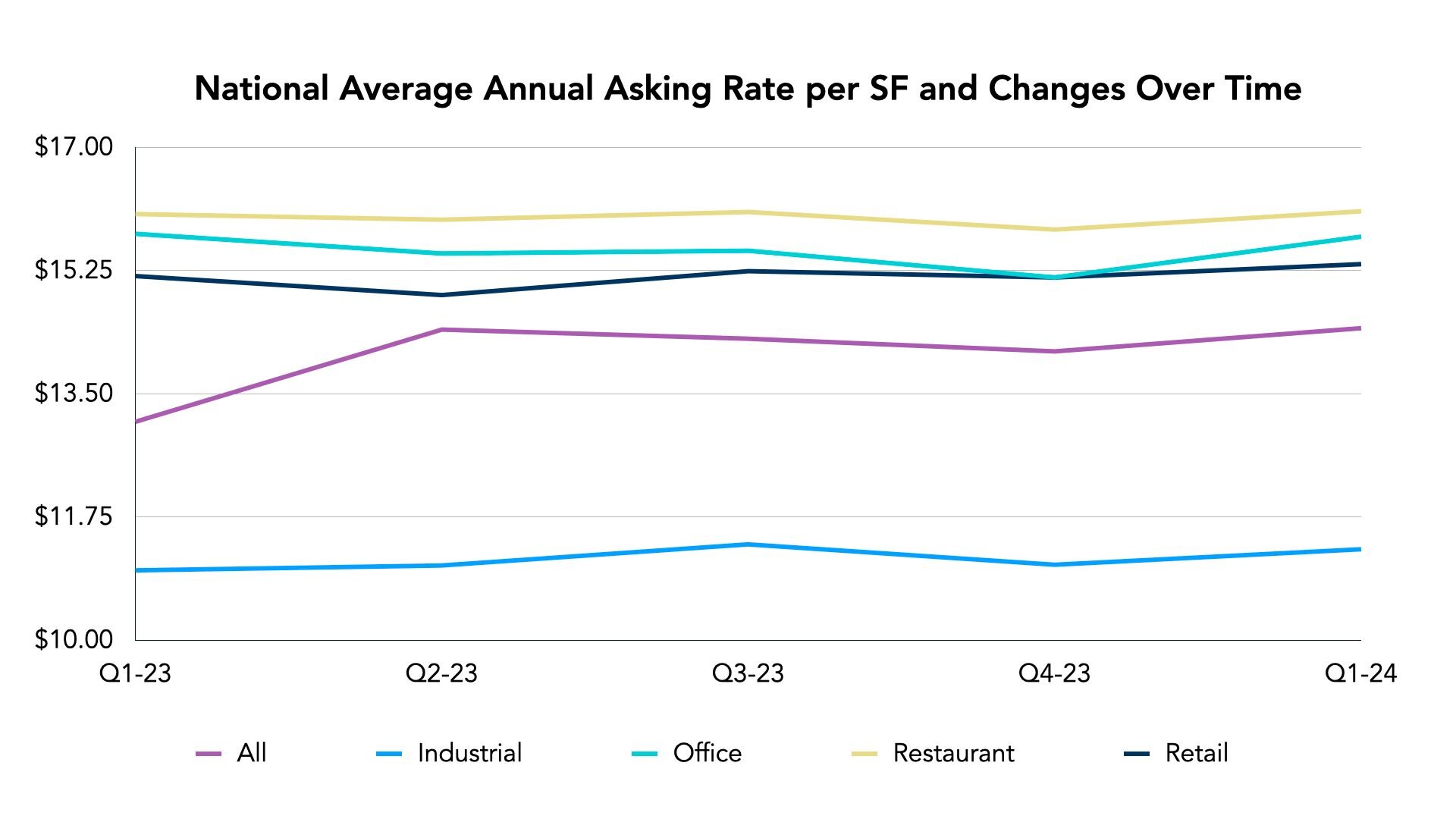

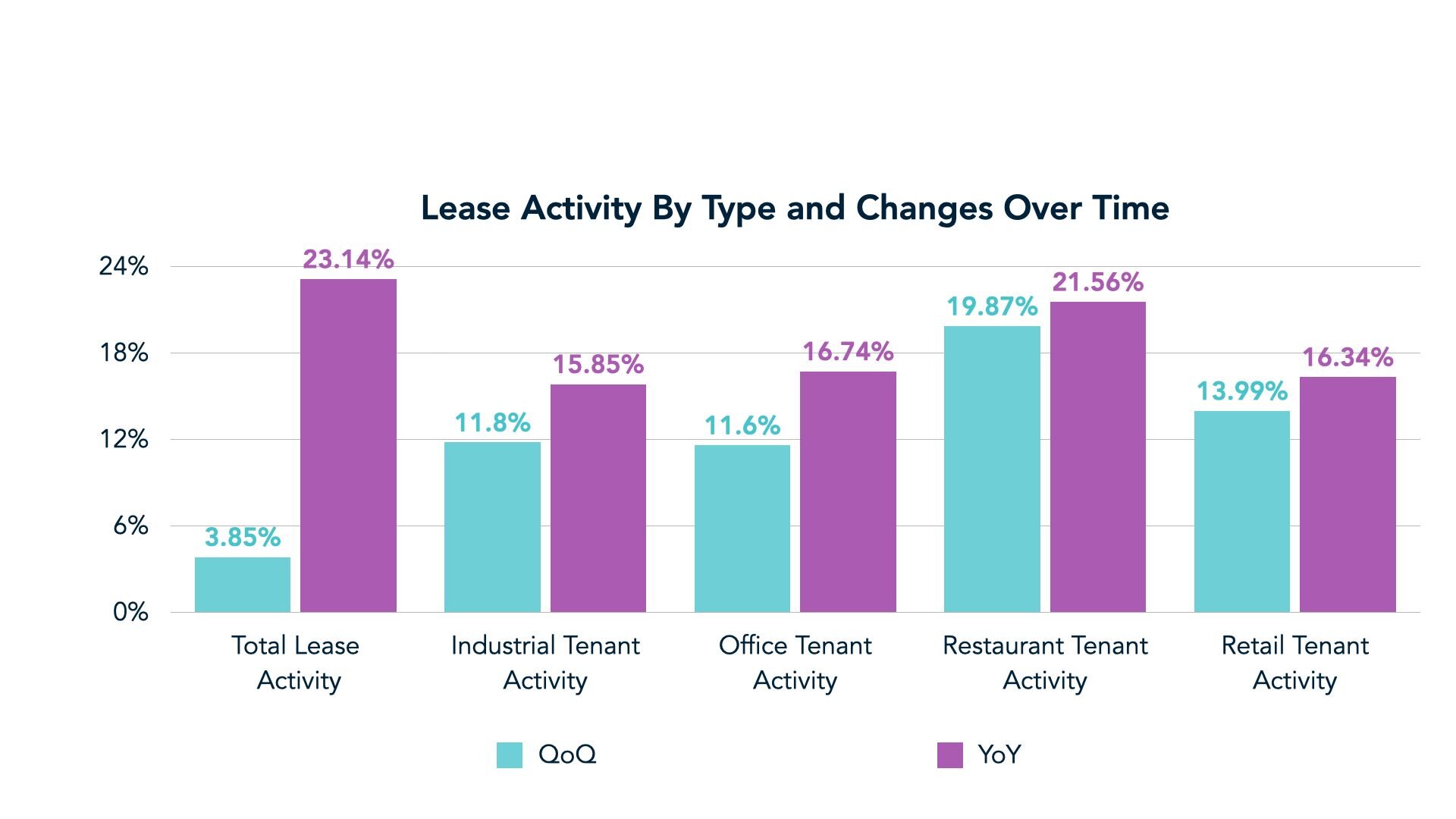

Commercial Real Estate National Trends

What the Data Says

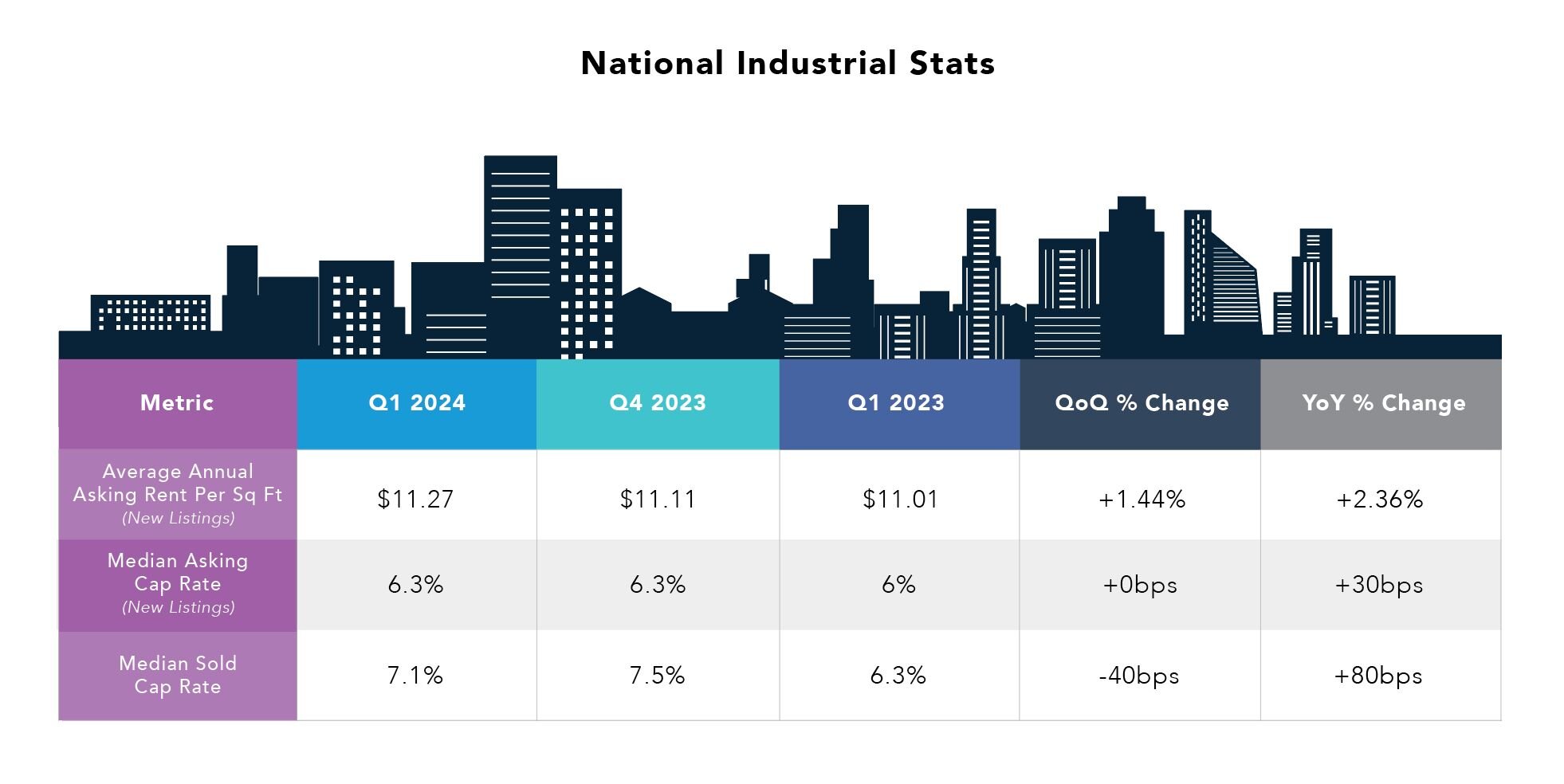

Industrial

Amid an increasingly stable e-commerce sector and increased focus on reshoring to strengthen supply chains and domestic manufacturing, the demand for industrial space soared last cycle, leading to stiff competition for existing warehouses and manufacturing sites. This demand surged particularly during the pandemic, in part a result of last-mile e-commerce focus during lockdowns, with average absorption rates in 2021 doubling that of the previous five years and continuing to outpace by over 60% in 2022, severely limiting supply.

To address this, a record-breaking wave of construction was scheduled to begin at the end of 2023, despite certain markets experiencing ultra-low vacancies and robust rent growth across the U.S. This has led to a tapering off of the sector’s fundamentals, with an abundance of supply eating into the high-velocity rent growth as experienced in years past as demand.

Despite construction hurdles, such as high costs, supply chain issues, and protracted delivery timelines, the sector benefits from a long-term positive outlook, thanks to e-commerce’s gains, healthy consumer spending, and continued onshoring incentives.

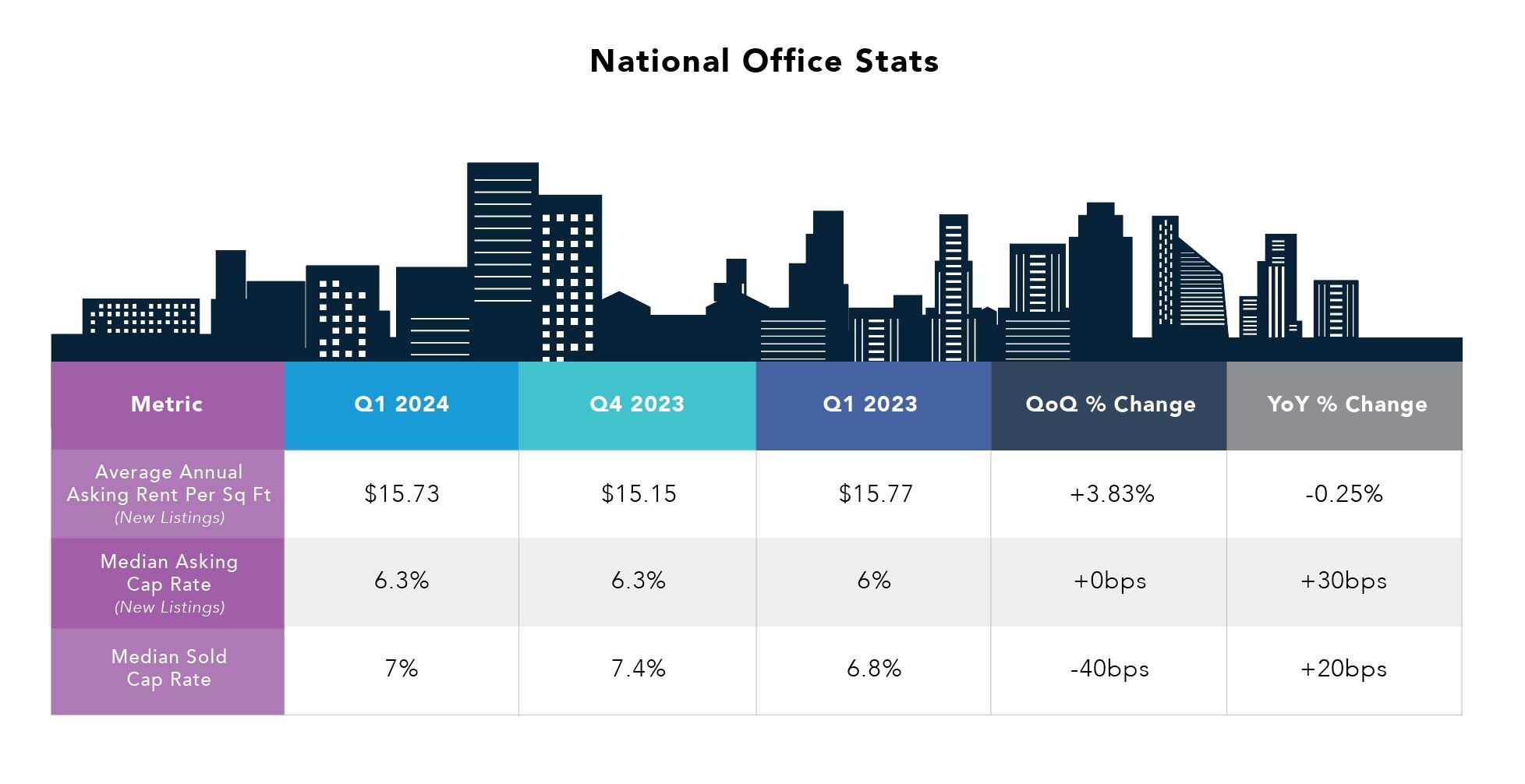

Office

Despite a striking increase in office jobs since 2020, r emote and hybrid work (among other factors) have significantly reduced occupied office space and a decline in asset values, exacerbated by economic uncertainties and a cautious approach to new lease signings through early 2024.

However, not all offices are created equal. Newer, high-quality office assets designed for hybrid work have outperformed and driven up overall sector valuations nationally, absorbing significant amounts of unused space and bifurcating the value gap between Class A and B/C. Office stakeholders are also moving with more confidence in making space-related decisions, with a flight to quality driving most moves. More informed about their space needs, a majority expect office utilization to stabilize by the first half of 2024, according to CBRE’s most recent office occupier survey.

The office sector faces a pivotal moment, like retail before it, with a significant portion of the U.S. office inventory requiring reinvestment or upgrades. Owners and investors must consider generous tenant improvement allowances, adaptive reuse or conversion, or redevelopment for underperforming assets. According to Business Insider, office conversions into multifamily units may become more viable in the next few years – they’re already up 357% since 2021. And overall limited supply from lack of new deliveries will help to stabilize the sector’s fundamentals.

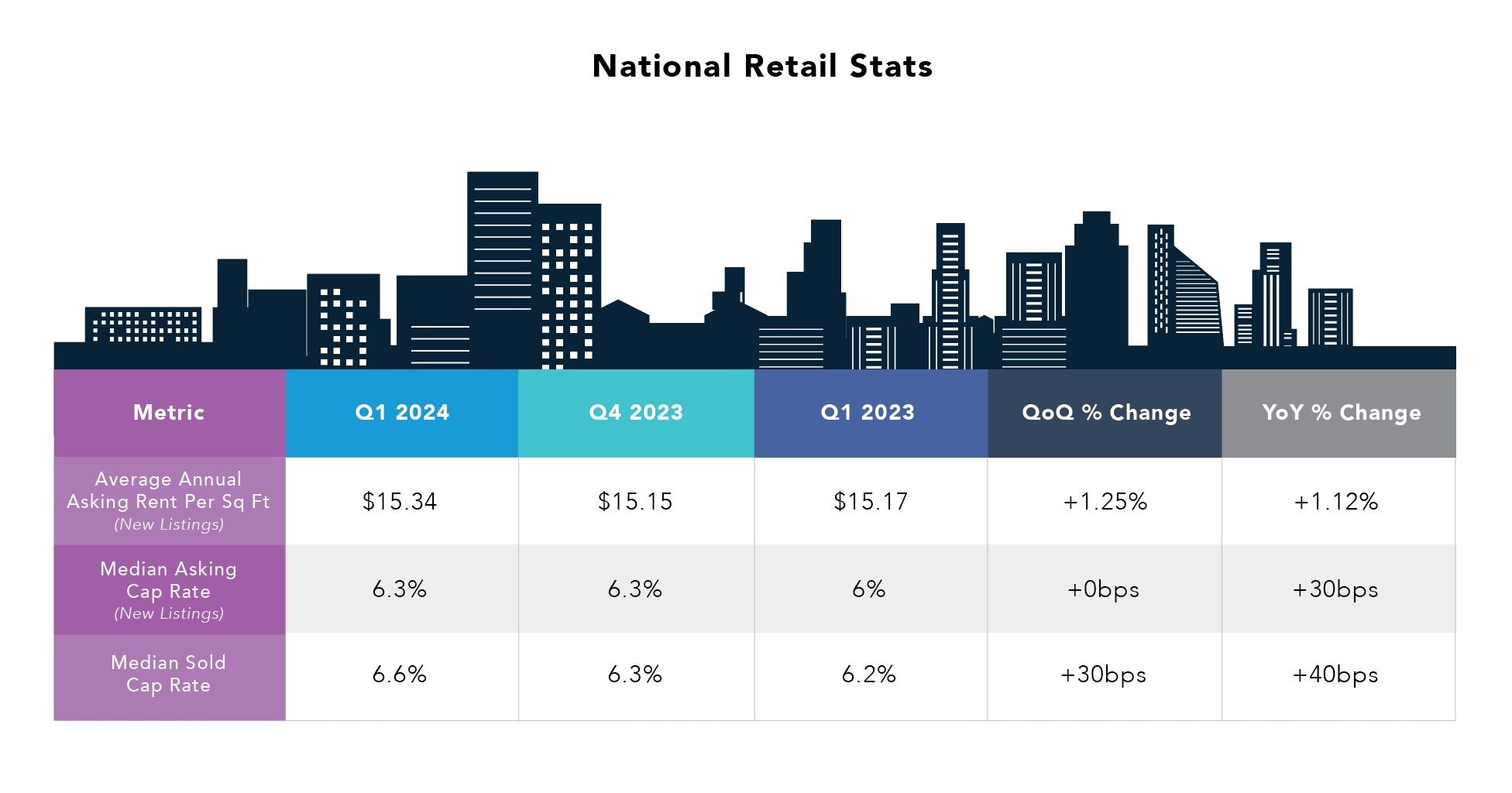

Retail

Consumer sentiment hit its highest levels since 2021 in March 2024, rising as inflation showed modest signs of cooling and perceptions improve amid record-low unemployment numbers. Fueled by improved consumer spending (sales up 3.2% overall in 2023) and hiking demand from retail tenants, the retail sector continues its recent streak of strong growth, fueled by years of industry transformation and consolidation among retailers in prime locations.

Retail’s resilience is evident in the U.S., where store openings significantly surpassed closures in 2023 for the second straight year, and leasing activity and rent growth (up nearly 30% annually) continue to be the most robust by far on Crexi’s platform. Landlords are optimistic, reassured by the retail sector’s survival and growth post-pandemic, limited new retail development, and a favorable supply-demand balance.

Meanwhile, e-commerce remains a key growth driver, with many retail executives aiming to enhance their digital offerings. The growth rate of e-commerce has stabilized since the pandemic’s peak, suggesting that integrating digital capabilities with physical stores could spearhead future retail success. Retailers focusing on improving last-mile distribution, omni-channel logistics, and online presence will likely lead the next wave of retail evolution, with landlords eager to accommodate these forward-thinking tenants.

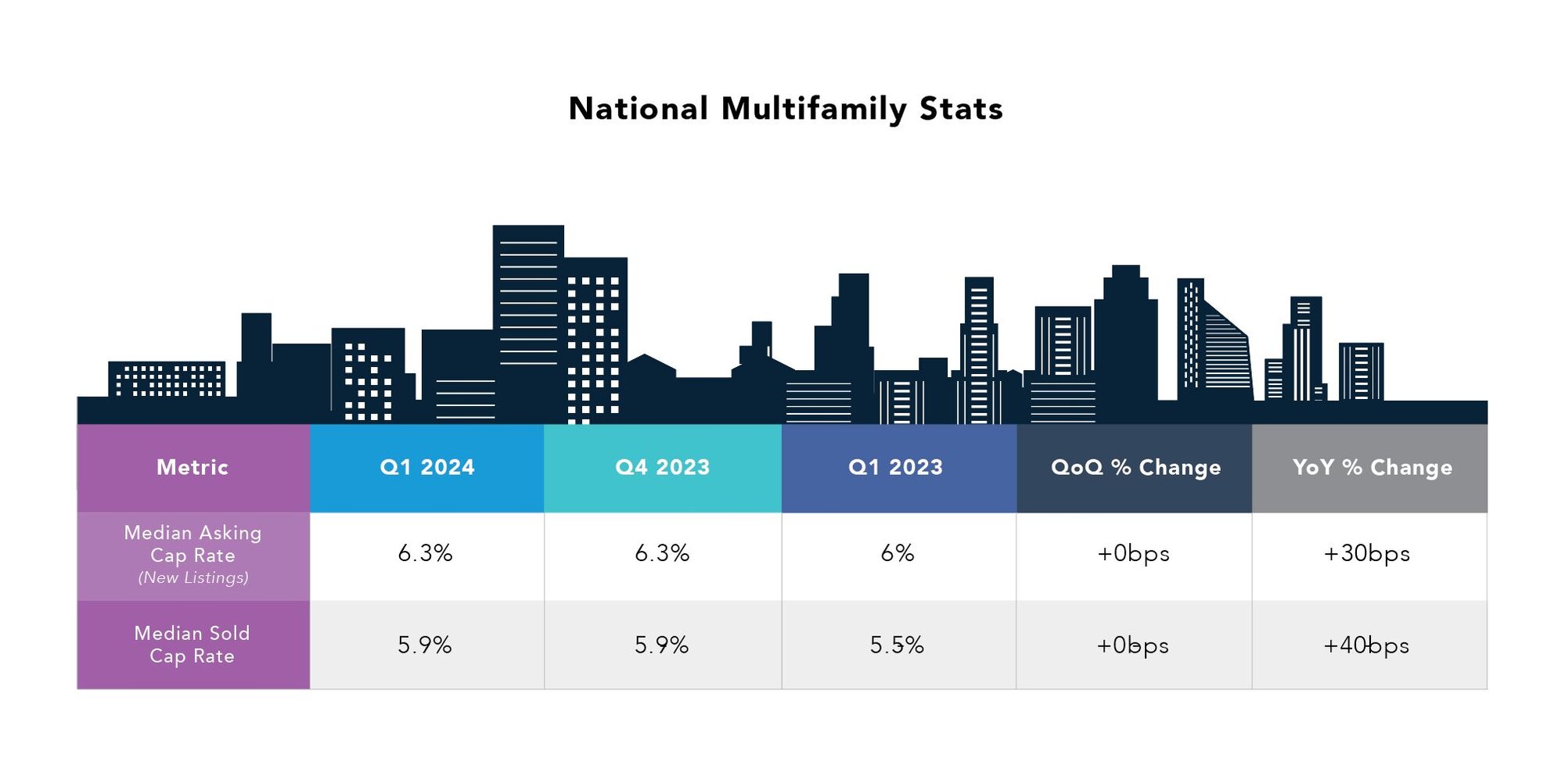

Multifamily

Following the 2022-2023 wave of interest rate hikes, the housing market pivoted from its pandemic-era boom, leading to price corrections in several markets. Higher mortgage costs and limited access to capital have subdued buyer activity, sustaining the heightened demand for multifamily rental properties witnessed since the pandemic. Rent growth has exceeded 20% in most U.S. markets since 2020.

Affordability remains a critical challenge, particularly for r enters and first-time buyers, and potential solutions depend significantly on government responses. Policies promoting more lenient zoning and financial incentives like low-interest loans or tax breaks could alleviate some pressure, though local inflexibility has often hindered widespread adoption of such measures.

The creation of new, affordable housing stock remains constrained globally due to high construction costs and financing challenges, with single-family housing construction not expected to recover until 2025. The ongoing supply-demand imbalance makes multifamily rentals increasingly attractive, especially for those unable to enter the home buying market. This suggests that rental property demand will remain robust as potential buyers hold for an opportune moment to purchase and younger generations continue to prefer renting to owning.

Regional Commercial Real Estate Trends

Final Thoughts

2024 may be another year layered with unpredictability, but it also offers many more exciting opportunities. Early signs point to increasing stability amid a new normal on the horizon. Innovation and boldness are set to redefine the space market, casting a spotlight on commercial real estate evolution for the remainder of the year.

The strategies industry leaders employ over the next several months will be pivotal in laying the foundation for enduring success. We’re excited about the potential of these changes and remain confident in the sector as a whole.

Metrics and Methodology

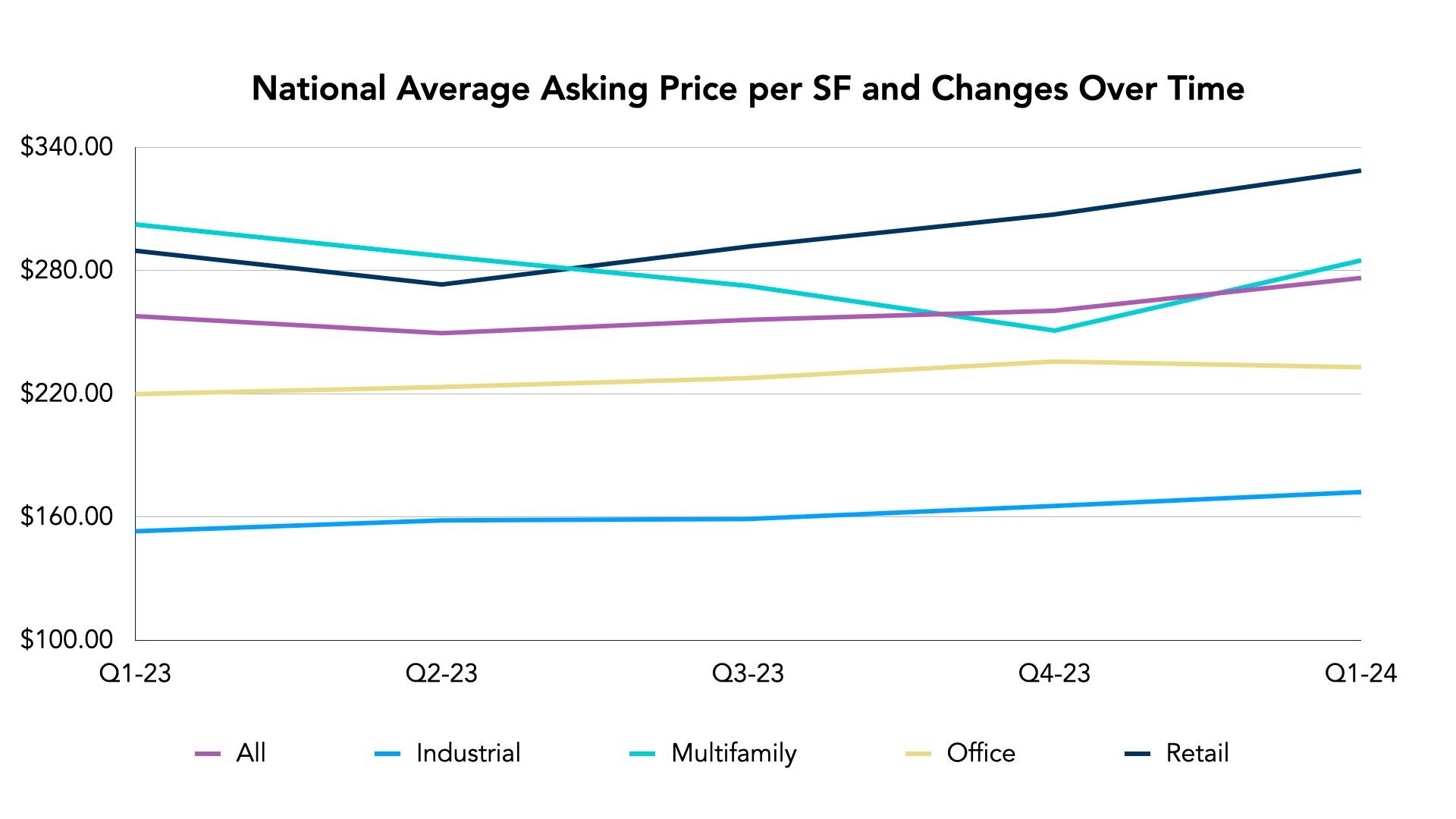

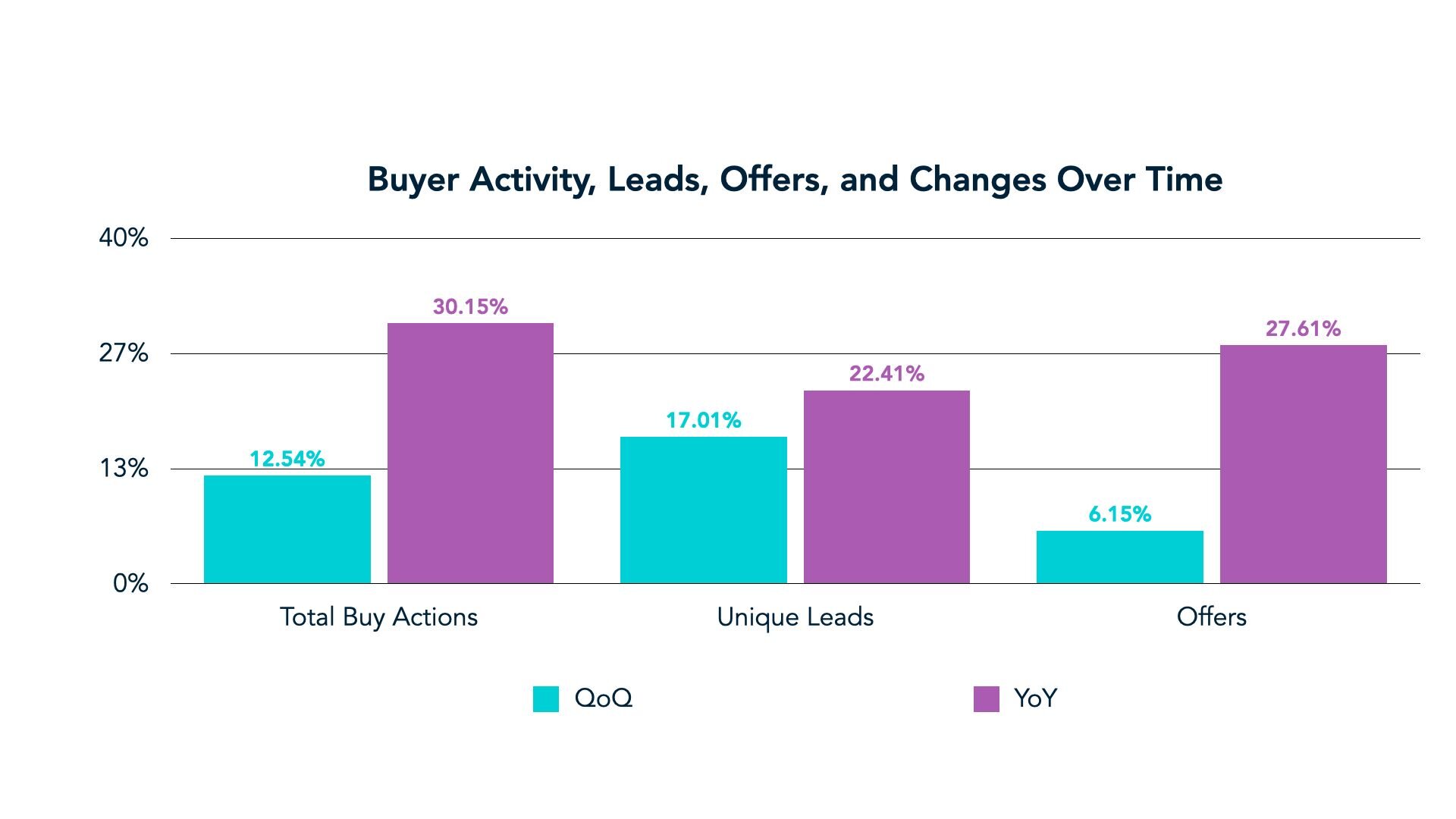

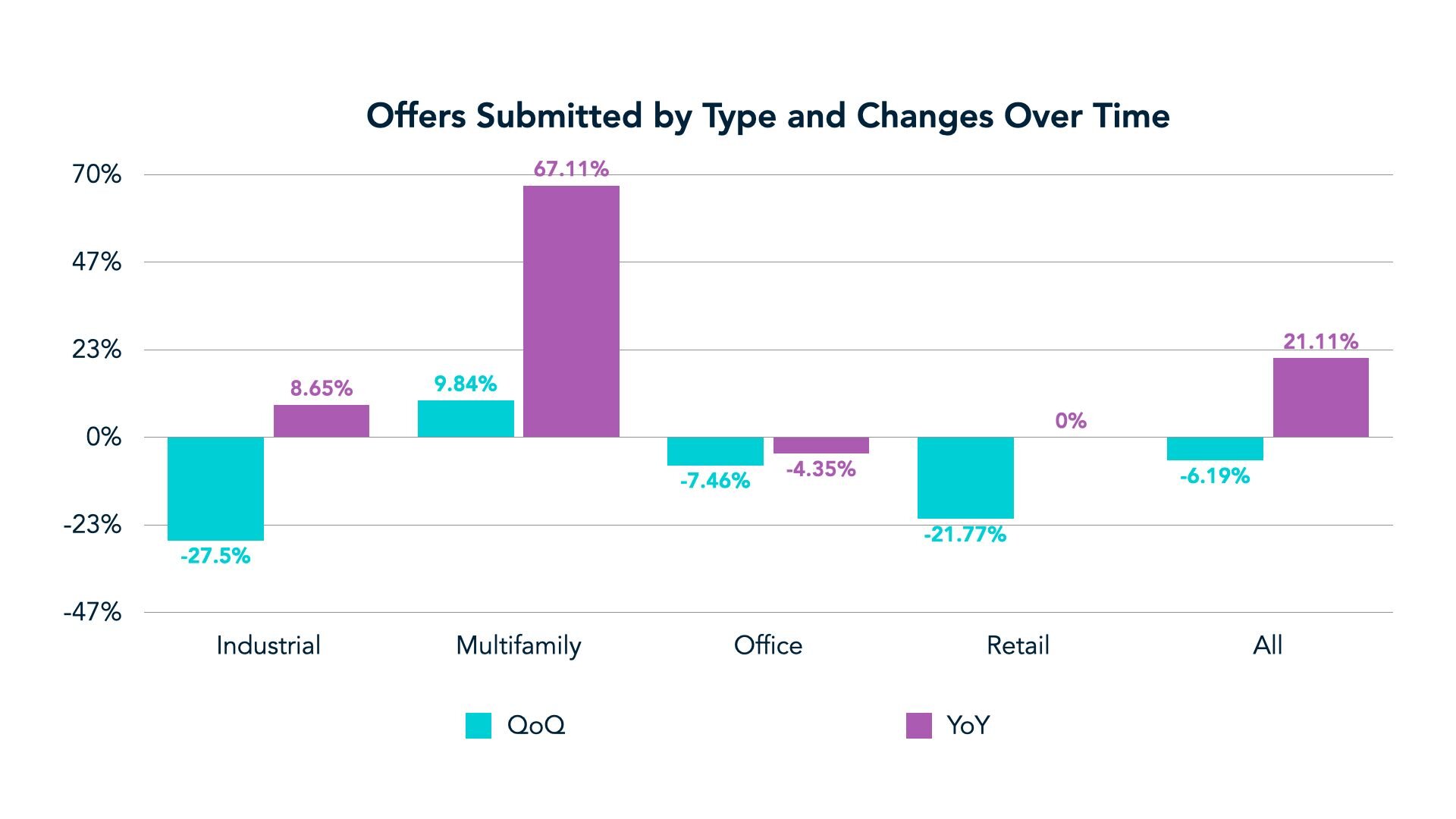

This article relies on data from Crexi’s marketplace. In particular, to ascertain timely and representative trends in seller sentiment, this article focuses on offering metrics, such as average asking price per square foot, cap rate, and monthly rents, in addition to listed occupancy, tenancy, and square footage. Using these listing-based metrics and changes therein, we can use seller expectations at the time of listing to approximate overall valuation trends.

While these data aggregations may broadly reflect prevailing market conditions, it is essential to note that variations can also be affected by inventory changes, asset size, etc. We pair these data points with internal data from Crexi buyers on search trends and acquisition-related actions performed on Crexi to provide a holistic understanding of where both sides of commercial real estate are headed.

Disclaimer

The information in this report is based on Crexi’s internal marketplace data and additional external sources that we consider reliable, but we do not represent it is accurate or complete.

Crexi internal marketplace data consists of aggregated property-level data points provided by brokers and reviewed internally by Crexi. While these data aggregations may largely reflect prevailing market conditions, variations can also be affected by inventory changes, asset size and other factors.

Nothing contained on this report or website is intended to be construed as investing advice. Any reference to an investment’s past or potential performance should not be construed as a recommendation or guarantee towards a specific outcome. The information, opinions, estimates and forecasts contained in this report are as of the date of the article and ar e subject to change without prior notification.