The Pittsburgh Commercial Real Estate Market

February 20, 2026

Key Takeaways

- Industrial investors should prioritize highway-adjacent, modern warehouse assets — well-located product is still trading while older flex and manufacturing buildings sit.

- Office tenants have negotiating power right now, with 17.3% vacancy and zero new construction underway, particularly in submarkets outside Greater Downtown and Parkway West.

- Retail plays best in experiential and service categories in walkable neighborhood corridors, with mixed-use developments like Esplanade signaling where the next wave of value is forming.

- Multifamily fundamentals remain solid — 5.6% vacancy and steady absorption make Pittsburgh a reliable income play, especially near employment hubs on the South Side and East Carson Street.

- Pittsburgh's GDP has grown 39% since 2020, giving investors an economic anchor that most Rust Belt markets can't match — this is a long-term hold market, not a speculative one.

Pittsburgh has quietly become one of the more stable and adaptable commercial real estate markets in the Northeastern U.S. Once defined by steel production and heavy industry, the city now runs on healthcare, higher education, robotics, financial services, and advanced manufacturing. That shift has reshaped not only its economy, but also the types of properties attracting attention across the region.

Crexi helps brokers and investors navigate Pittsburgh commercial real estate with access to active listings, off-market research tools, and market intelligence designed to support smarter decisions. From identifying acquisition opportunities to marketing properties for sale or lease, our platform connects local stakeholders with qualified buyers and tenants already focused on Western Pennsylvania. Nationally, Crexi has supported more than $615 billion in closed transactions and helped market over $7 trillion in commercial property value.

We proudly serve Pittsburgh and surrounding communities including Ross Township, Homestead, Bethel Park, Bridgeville, and neighboring submarkets. As the market and CRE technology continue to evolve, having reliable data and efficient deal tools matters more than ever. Crexi provides a centralized platform built for today’s commercial real estate professionals.

Pittsburgh Commercial Real Estate Overview

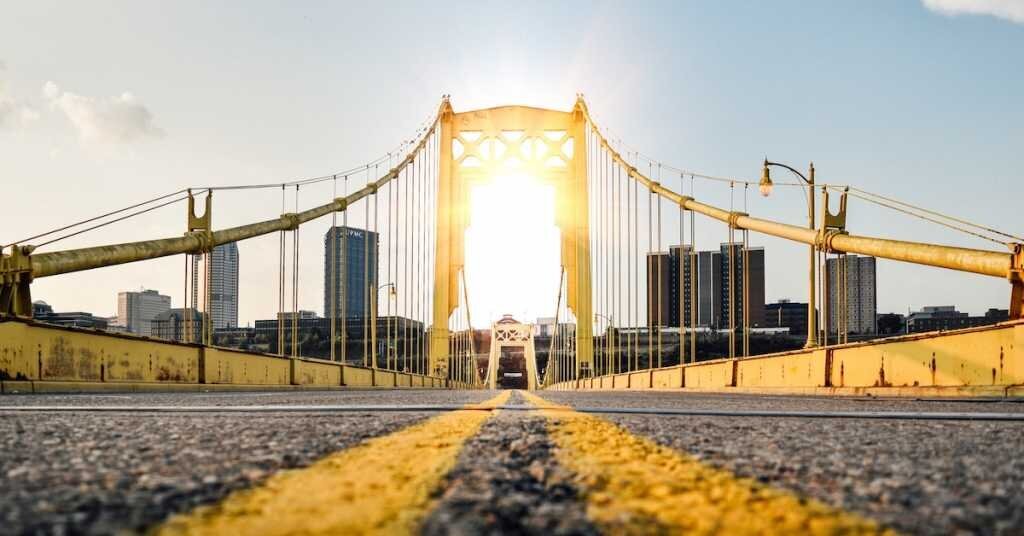

Set at the meeting point of the Allegheny and Monongahela rivers, Pittsburgh has long been shaped by geography. Its river valleys, bridges, and hillsides created the industrial backbone that once defined the Steel City. Today, that physical landscape still influences how the region grows, but the economic story has evolved.

Over the past two decades, Pittsburgh has quietly rebuilt itself into a center for healthcare, higher education, robotics, advanced manufacturing, and financial services. Major institutions like UPMC, Carnegie Mellon University, and the University of Pittsburgh anchor employment and attract research funding, talent, and long-term investment. The result is an economy that feels balanced rather than boom-and-bust.

That foundation carries into commercial real estate. Instead of dramatic swings, Pittsburgh’s market tends to move at a measured pace. Office demand is tied closely to healthcare and research activity. Industrial and flex space benefit from the region’s strategic access to Midwest and East Coast markets. Multifamily performance reflects steady employment and neighborhood revitalization in areas like the Strip District, Lawrenceville, and the North Shore.

What often surprises newcomers is the city’s livability. Distinct neighborhoods, walkable business districts, and expansive park systems like Frick Park and Riverview Park contribute to quality of life, a factor that increasingly matters in tenant and employer decisions. For investors and brokers, Pittsburgh offers something rare: a market supported by institutional depth, practical pricing, and long-term economic drivers rather than short-lived momentum.

Pittsburgh Regional Context

Pittsburgh’s regional reach extends well beyond the city limits, with a metro area that plays a central role in western Pennsylvania’s economy. After years of gradual population decline, the city has started adding residents again, recovering pandemic-era losses and posting one of its strongest recent growth periods in decades.

Beyond the numbers, Pittsburgh continues to be celebrated for its museums, performing arts, sports culture, and food scene. Combined with a high quality of life and a strong sense of community, those factors help explain why the region draws both residents and investors.

- Home to nearly 2.5 million in the metropolitan area, Pittsburgh has more than 307,000 residents within its city limits.

- Greater Pittsburgh includes Allegheny, Armstrong, Beaver, Butler, Fayette, and Westmoreland counties.

- The median age in Pittsburgh is 34.5, which is about 20% lower than the overall figure for the state.

- Per capita income is $46,628, and median household income is $66,954, with about 33% of households earning $100,000 or more annually.

- Over 53% of Pittsburgh residents hold a bachelor’s degree or an advanced degree, about 1.5 times higher than the rate in Pennsylvania overall.

- The three most prominent universities in the metropolitan area are the University of Pittsburgh, Carnegie Mellon University, and Duquesne University.

- The cost of living in Pittsburgh is still below the national average, giving residents and businesses a chance to stretch their budgets without giving up the amenities, culture, and overall quality of life that make the city appealing.

- In addition to earning recognition for its arts and culture scene, professional sports teams, and entertainment, Pittsburgh has also been named a top city for college grads, retirees, and tourists alike.

Pittsburgh Job Market

Pittsburgh’s job market reflects a city that has strategically expanded beyond its roots in steel production. Today, healthcare, higher education, financial services, technology, and life sciences form a steady economic base.

With graduates coming from dozens of colleges and universities across the region, employers have access to an exceptional pool of talent. Established institutions provide stability, while growth in AI, robotics, and advanced manufacturing adds new energy. That balance continues to support business confidence and long-term commercial real estate demand.

- GDP for Pittsburgh MSA is $194 billion, growing by more than 39% since 2020 alone, according to the St. Louis Federal Reserve.

- The unemployment rate is 3.6% (December 2025), with the mining and logging, education and health services, and financial activities sectors among the fastest growing.

- The largest employers in Pittsburgh are the University of Pittsburgh (and its affiliated medical center), Highmark Health, PNC Bank, University of Pittsburgh, Giant Eagle, and Eat’n Park.

- Although Pittsburgh is famously known as the “Steel City,” its key industries have expanded to include life sciences, business services, healthcare, AI, distribution and logistics, and more.

- Global companies such as Amazon, Apple, Google, and Meta have come to Pittsburgh and its surrounding area, contributing to a flourishing business landscape.

- WalletHub ranks Pittsburgh as the 4th best metro area for STEM jobs in the US.

- The state of Pennsylvania nurtures business development with corporate tax credits for investment, job creation, research and development, and historic preservation, as well as relatively low business taxes and breaks for small businesses.

- Transportation infrastructure includes the Pittsburgh International Airport (PIT), major interstates like I-79 and I-376, and the Port of Pittsburgh - one of the busiest inland ports in the nation.

Pittsburgh Industrial Market

Pittsburgh’s industrial market is moving through a reset after a stretch of heavy development. Vacancy has ticked up as the market works through newer deliveries, particularly among older manufacturing and flex buildings. At the same time, modern warehouse and distribution space, especially properties with strong highway access, continues to draw steady interest.

The recent sale of 460 Nixon Road in Northeast Pittsburgh is a good example, showing that well-located industrial assets can still command investor attention. Overall, activity is there, but decisions are more thoughtful, with a clear preference for quality and functionality.

Industrial market overview (Cushman & Wakefield Industrial Market Report Q4 2025)

- Inventory: 166,073,889 SF

- Vacancy rate: 6.5%

- Absorption: -684,160 (YTD 2025)

- Key leases by tenant: EOS Energy (432,203 SF), Confidential tenant (109,348 SF), Welly Bottle (80,000 SF)

- Under construction: 447,482 SF

- Largest submarkets: Westmoreland County, South Pittsburgh, West Pittsburgh, Northeast Pittsburgh

Crexi Insights

These are the most recent industrial lease and sales trends from Crexi Insights (as of February 2026):

For Lease (active)

- Asking rate/SqFt (median): $12 per year

- Median SqFt/listing: 8,490

- Days on market: 224

- Total listings on Crexi: 96 spaces

For Sale (active)

- Median asking price: $1.2 million

- Price/SqFt: $94

- Asking cap rate: 13.4%

- Days on market: 239

- Total listings on Crexi: 35listings for a total of 724,600 SF

Sales Comps (past 12 months)

- Median sold price: $282,500

- Total sales volume: $31.4 million

- Median SqFt sold/transaction: Unavailable

- Median price/SqFt: $118

- Median days on market: 526

Pittsburgh Office Market

After a few unsettled years, the office market is starting to feel more balanced. With no new projects breaking ground, the focus has shifted to filling the space that already exists, and some submarkets are beginning to see progress.

Tenants have been gravitating toward well-located, updated buildings, especially in Greater Downtown and Parkway West, while older properties continue to face more competition. Vacancy is still higher than many would like, but the tone of the market feels steadier as 2026 approaches.

Market overview (Cushman & Wakefield Office Market Report Q4 2025)

- Inventory: 94,292,289 SF

- Vacancy rate: 17.3%

- Absorption: 35,245 (YTD 2025)

- Key leases by tenant: Clark Hill (67,959 SF), Aries (45,000 SF), PwC (43,308 SF)

- Under construction: 0 SF

- Largest submarkets: Central Business District, Greater Downtown, Parkway West

Crexi Insights

For the latest insights into Pittsburgh's office market, turn to Crexi. Here are the real-time office leasing and sales trends as of February 2026:

For Lease (active)

- Asking rate/SqFt (median): $20 per year

- Median SqFt/listing: 1,444 SF

- Days on market: 289

- Total listings on Crexi: 518 spaces

For Sale (active)

- Median asking price: $830,000

- Price/SqFt: $94

- Asking cap rate: 7.4%

- Days on market: 238

- Total listings on Crexi: 93 listings totaling 2 million SF

Sales Comps (past 12 months)

- Median sold price: $410,000

- Sold price/SqFt: $141

- Total sales volume: $39.5 million

- Median SqFt sold/transaction: 2,580 SF

- Days on market (median): 414

Pittsburgh Retail Market

Retail across Pittsburgh feels steady, even if it’s not moving at the breakneck pace seen a few years ago. Some vacancies have ticked up, and leasing has become more measured, but well-located centers and neighborhood corridors are still drawing interest from service and experiential tenants.

At the same time, projects like the planned reinvestment in Station Square and the Esplanade development along the river are giving parts of the city a fresh chapter, blending retail with residential, hospitality, and entertainment. It’s a market that’s adjusting, with growth happening in deliberate, location-driven ways.

Market overview (Colliers Q4 2025)

- Inventory: 152,085,138 SF

- Vacancy rate: 5.1%

- Absorption: -806,873 (YTD 2025)

- Under construction: 133,132 SF

- Largest submarkets: South Pittsburgh, Westmoreland, North Pittsburgh

Crexi Insights

Retail lease and sales trends from Crexi Insights (as of February 2026):

For Lease (active)

- Asking rate/SqFt (median): $17 per year

- Median SqFt/listing: 2,966 SF

- Days on market: 247

- Total listings on Crexi: 325 spaces

For Sale (active)

- Median asking price: $800,000

- Price/SqFt: $158

- Asking cap rate: 7.1%

- Days on market: 174

- Total listings on Crexi: 109 listings for a total of 1.8 million SF

Sales Comps (past 12 months)

- Median sold price: $440,000

- Sold price/SqFt: $211

- Total sales volume: $95.6 million

- Days on market (median): 393

Pittsburgh Multifamily Market

Pittsburgh’s multifamily market has remained relatively balanced, even as leasing momentum cooled slightly toward the end of the year. Demand is still supported by a mix of young professionals, students, and renters who are priced out of homeownership, helping keep occupancy levels healthy.

New construction continues, though developers are moving carefully as financing and building costs remain elevated. Popular neighborhoods like the South Side and East Carson Street highlight where renters are gravitating, drawn to walkability, amenities, and proximity to jobs and entertainment.

Market overview (Colliers Q4 2025)

- Multi-unit inventory: 167,404

- Vacancy rate: 5.6%

- Average asking rent: $1,319

- Absorption: 187 units (Q4 2025)

- New construction: 324 units

- Most popular neighborhoods for renters (Rent.com): South Side Flats, South Side Flats, East Carson Street

Crexi Insights

Here are the most recent multifamily insights from Crexi (as of February 2026):

For Sale (active)

- Median asking price: $647,500

- Price/SqFt: $98

- Price/Unit: $151,700

- Asking cap rate: 8%

- Days on market: 244

- Total listings on Crexi: 50 listings totaling 304,900 SF

Sales Comps (past 12 months)

- Median sold price: $219,500

- Sold price/SqFt: $119

- Sold price/unit: $138,200

- Total sales volume: $292 million

- Sold cap rate: 7.4%

- Total SqFt sold: 1.1 million SF

Get more in-depth Pittsburgh market data with Crexi Intelligence.