The Role of Credit Ratings in Commercial Real Estate Financing

Guest Contributor

April 22, 2024

Investing in commercial real estate can be appealing for many reasons. Commercial investments can provide stable cash flow, help diversify your portfolio, hedge against inflation, and may even come with tax advantages. If an asset performs well and generates cash flow, you might think you can get away with a lower-than-average credit score when applying for a new investment or commercial real estate loan. However, your credit score still plays a vital role in commercial real estate financing.

If you’re a real estate investor applying for financing for a commercial real estate property, here’s what you need to know about credit scores and the loan approval process.

Credit Score vs Credit Rating

Your credit score reflects your financial habits, including how much debt you take on and how you pay your bills. Your lender might request this three-digit score when you apply for a home loan. However, a credit rating is used for businesses and is expressed as a grade, such as AA, A, or B. It is commonly used by businesses and governments to show how they handle debts and whether they have a history of missed payments.

Why Your Credit Score Matters

Whether you’re applying for an individual credit account or a commercial property loan for your LLC, your credit score tells lenders how responsible you are with your money. This three-digit score lets a lender know if you pay off your debts on time and in full.

Even if you act responsibly with your business's finances, any blips in your personal financial history can impact your ability to secure new financing. And while you can sometimes secure a loan with a lower credit score, you might pay more in upfront fees or annual percentage rates (APR) over the loan's lifetime.

What Credit Score Do You Need to Secure a Commercial Real Estate Loan?

Every lender has their own requirements when it comes to loan approval. However, the lender may choose to evaluate your personal credit score or your business's credit score (if your company has one), depending on the situation. It might also take both into account.

Individual Credit Score Requirements

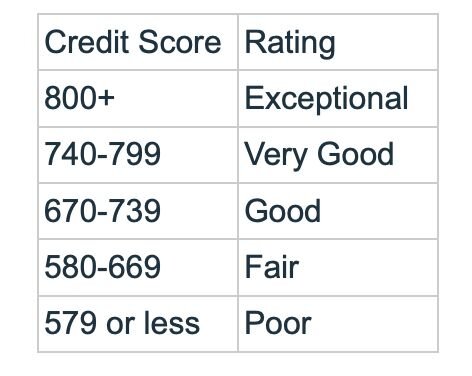

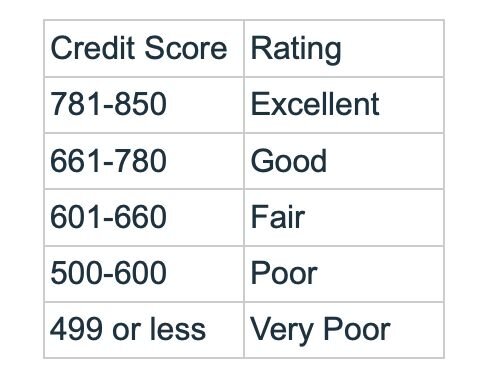

Your individual credit score is a three-digit number ranging from 300 to 850. There are two main models for evaluating credit — the FICO model and the VantageScore model. FICO is the most commonly adopted model, but make sure you know which model your lender uses.

FICO Credit Score ranges:

VantageScore Credit Score ranges:

Many lenders require a good to excellent/exceptional credit rating to get approved for a commercial real estate loan. A good rule of thumb is to have a 680 credit score or higher, though getting approved with a lower score is possible.

The higher your score, the more likely your chance of approval — and the more favorable terms you're likely to lock in.

Business Credit Score Requirements

Your business may also have a credit score that's weighed when considering your loan. The FICO Small Business Scoring Service issues business credit scores. These scores range from 0 to 300. You might get approved for a loan with a score over 140, but a score in the 200s is better and considered less risky.

There are a range of other business credit scoring models, with some ranging from 0 to 100. While you should aim for a higher business credit score, your credit score generally carries more weight in the decision process.

Factors That Make Up Your Credit Score

Your credit score consists of several components that go into creating this three-digit glimpse into your financial habits. They include:

- Payment history: Accounting for 35% of your credit score (FICO), this factor determines whether you pay your bills on time and consistently. Any history of missed or late payments can ding your score — and may give a lender pause that you might not pay your bills reliably.

- Credit utilization: This makes up 30% of your score and refers to the amount of credit you use compared to your available credit. If you tend to carry balances on credit cards or use most of your credit lines in full, this can signal that you’re a borrowing risk. Lenders like to see low credit utilization ratios.

- Length of credit history: Making up 15% of your credit profile, this factor looks at the average age of your credit accounts. Having a longer history can boost your score, so it's generally good practice to keep older credit accounts open.

- Credit mix: This next factor accounts for 10% of your credit score and is concerned with your mix of credit, including credit cards, loans, mortgages, etc. You don’t need one of each type, but a good mix can help raise your score.

- New credit: This factor makes up 10% of your credit score. If you apply for multiple credit accounts in a short period, your score can drop. This signals to lenders that you may be in need of credit that you might not be able to pay back.

How to Raise Your Individual or Business Credit Score to Secure a Commercial Real Estate Loan

If your personal credit score is below 680 or your business credit score is lower than 140, there are some steps you can take to raise your score and improve your chances of getting approved for a commercial property loan.

First, make sure you’re current on all payments. Be sure to demonstrate a history of making on-time payments for at least six months to see improvements in your score.

Next, pay down large credit card balances to lower your credit utilization rate. If you can’t fully pay off your balances, work on chipping away at this debt to give your credit score a slight boost.

Be sure to apply this same process to your business accounts. Always pay at least the minimum amount due (but more if you can) on time, every month. Do this consistently, and you should see improvements in your scores over time.

Other Factors Go Into Your Loan Approval

Whether you invest in commercial properties to generate rental income or seek to upgrade and sell them to prospective buyers, knowing lenders' financing requirements matters. While a good credit score is critical to getting approved for a commercial property loan, lenders also look at your loan-to-value (LTV) ratio, debt service coverage ratio, personal guarantee, as well as the performance of your current investments.

You can talk to a trustworthy real estate agent to get advice about what most lenders in your area look for in a borrower. And when you’re ready to buy, find your next investment property on Crexi’s marketplace.

About Ben Mizes:

Ben Mizes is the Co-Founder and CEO at Clever Real Estate, the nation’s leading real estate education platform for home buyers, sellers, and investors.