Crexi National Commercial Real Estate Report: January 2026

Welcome to the January 2026 release of our Crexi Market Trends Report, where we analyze Crexi's database each month to identify relevant activity and patterns, and share key insights for our users.

This national commercial real estate market update, based on Crexi Intelligence data and commercial property listings, highlights key CRE pricing, leasing, and investment trends from January 2026. With this information, we aim to equip commercial real estate professionals with actionable learnings to make well-informed decisions.

Key Takeaways

- Retail leads all sectors with 25.84% year-over-year price growth and vacancy dropping to 4.9%, driven by limited new supply and strong consumer spending in grocery-anchored and neighborhood shopping centers.

- Office is showing signs of stabilization, with vacancy improving 90 basis points month over month to 20.7% and prices up 8.03% year over year, suggesting the sector has likely bottomed as return-to-office momentum builds.

- Industrial experienced the most dramatic vacancy improvement, falling 720 basis points year over year to 21.50%, as construction pipelines contract and third-party logistics demand accelerates into 2026.

- Multifamily is positioned for a rent growth recovery, with vacancy compressing 120 basis points month over month to 12.60% and construction deliveries declining, creating opportunities ahead of anticipated second-half fundamentals improvement.

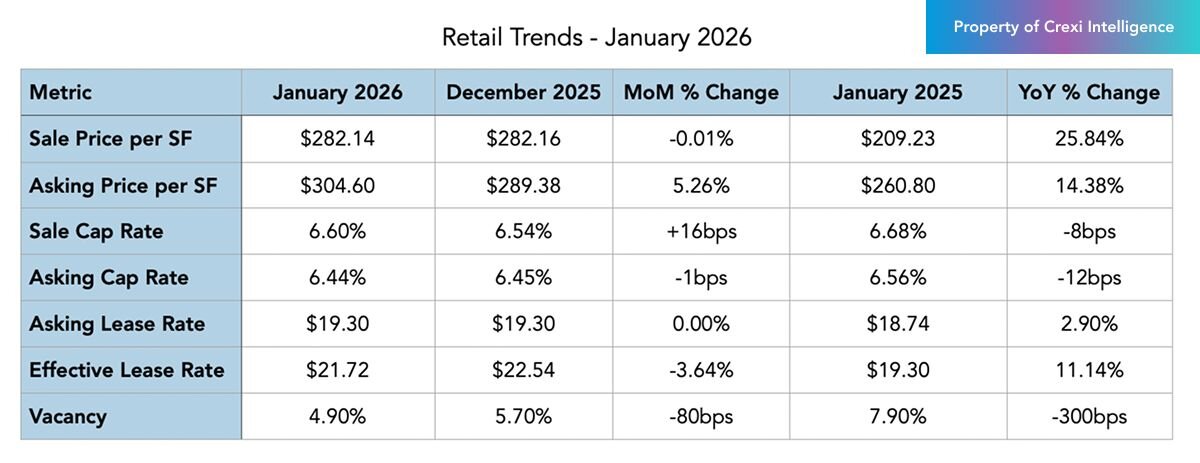

Retail Market Analysis

For Sale

Pricing: Retail sale prices on Crexi held essentially flat in January 2026 at $282.14 per square foot, declining 0.01% from December's $282.16. However, the year-over-year picture is far more compelling, with prices surging 25.84% from January 2025's $209.23 per square foot, reflecting renewed investor confidence and strong market fundamentals. Asking prices demonstrated notable monthly momentum, climbing 5.26% to $304.60 per square foot from December's $289.38, while maintaining robust year-over-year growth of 14.38%.

Cap Rates: Sale cap rates on Crexi rose slightly to 6.60% in January, up 16 basis points from December's 6.54% but tightening 8 basis points compared with January 2025's 6.68%. This year-over-year compression signals improving asset performance and investor appetite for retail properties. Asking cap rates remained stable at 6.44%, down just 1 basis point month over month and 12 basis points year over year, demonstrating consistent pricing expectations among sellers.

Vacancy: Retail vacancy on Crexi continued its impressive decline, dropping to 4.90% in January from 5.70% in December, an 80-basis-point improvement. The year-over-year trajectory is even more striking, with vacancy falling 300 basis points from January 2025's 7.90%. This sustained tightening reflects limited new retail supply and robust consumer spending entering 2026, particularly in grocery-anchored and neighborhood shopping

For Lease

Asking vs. Effective Lease Rates: Asking lease rates held steady at $19.30 per square foot in January, matching December's level but marking a 2.90% increase from the prior year's $18.74. More notably, effective lease rates jumped 11.14% year over year to $21.72 per square foot, despite a 3.64% monthly decline from December's $22.54. The widening gap between effective and asking rates suggests landlords are successfully commanding premiums in tight markets while maintaining competitive base rents.

The Big Picture

“We continue to see momentum grow as we move into 2026 across multiple product types. Retail has experienced strong demand combined with limited new supply, which has driven down vacancy rates and made retail an attractive asset class for investors.” - Adam Siegel, VP of Product Growth at Crexi

The retail sector is experiencing what JPMorgan Chase describes as "good tailwinds with limited new supply," with active shopping centers posting their strongest valuations in a decade, excluding regional malls. Industry experts point to grocery-anchored and neighborhood shopping centers as particularly resilient performers, thriving especially in areas where office usage has increased. The sector's strength is intrinsically linked to robust consumer spending, with Newmark Research noting that the spending power of coming-of-age consumers will help retail navigate economic obstacles in 2026.

CBRE's 2026 outlook anticipates continued leasing recovery, driven by expanding grocery, discount and services retailers. This aligns with Crexi's data showing dramatic vacancy compression and strong pricing power. The tightening retail market reflects a structural shift: years of underbuilding following the pandemic have created supply constraints that favor landlords, while e-commerce integration and hybrid work patterns have stabilized demand in well-located properties. Cushman & Wakefield's fourth quarter report noted that retail market fundamentals improved throughout 2025, driven by limited new supply, robust backfilling activity and reduced uncertainty around tariffs and consumer spending — trends that appear to be carrying into early 2026.

Investment Implications: With vacancy at just 4.90% and falling, retail properties on Crexi are entering a landlord-favorable market that presents compelling acquisition opportunities for investors seeking stable cash flow. The 25.84% year-over-year price appreciation signals strong momentum, but buyers should focus on grocery-anchored and necessity-based retail where fundamentals remain strongest. Cap rate compression of 8 basis points year over year suggests continued pricing power, making this an opportune moment to acquire well-located retail assets before competition intensifies further.

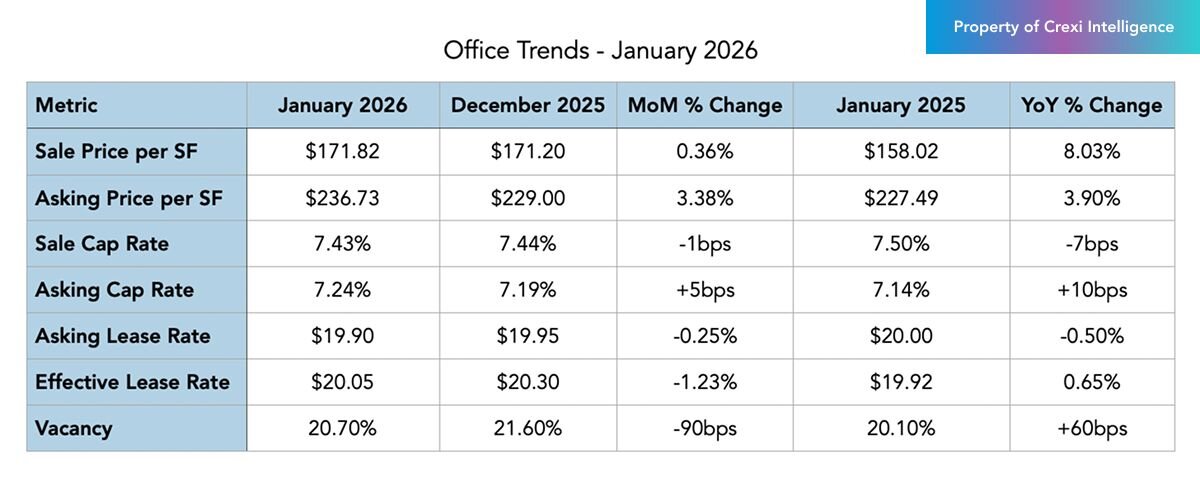

Office Market Analysis

For Sale

Pricing: Office sale prices on Crexi edged up 0.36% in January to $171.82 per square foot from December's $171.20, marking an 8.03% year-over-year increase from January 2025's $158.02. This sustained upward trajectory signals that office values may have finally bottomed after years of pandemic-related declines. Asking prices showed stronger monthly momentum, rising 3.38% to $236.73 per square foot from $229 in December, with year-over-year growth of 3.90%.

Cap Rates: Sale cap rates compressed slightly to 7.43% in January, down 1 basis point from December's 7.44% and tightening 7 basis points year over year from 7.50%. Asking cap rates moved in the opposite direction, expanding 5 basis points month over month to 7.24% and 10 basis points year over year, reflecting seller caution amid ongoing market uncertainty while actual transactions demonstrate improving fundamentals.

Vacancy: Office vacancy on Crexi improved to 20.70% in January from 21.60% in December, a 90-basis-point monthly decline. However, vacancy remains 60 basis points higher than January 2025's 20.10%, highlighting the sector's ongoing adjustment to absorption and hybrid work patterns. Despite this year-over-year increase, the monthly improvement suggests stabilization may be underway.

For Lease

Asking vs. Effective Lease Rates: Asking lease rates declined modestly to $19.90 per square foot in January from $19.95 in December, down 0.50% year over year from $20. Effective lease rates fell 1.23% month over month to $20.05 from $20.30 but remained 0.65% above the prior year's $19.92. The convergence between asking and effective rates, with effective rates now exceeding asking rates, suggests reduced concession packages as landlords regain negotiating leverage in select markets.

The Big Picture

“The office sector seems to have stabilized, and we're beginning to see prices recover in many markets. With many RTO mandates starting in January 2026, vacancy rates are starting to show some meaningful improvement in the right direction. It might take some time before we see a full recovery to pre-pandemic levels, but for now, the story is starting to shift to a more positive outlook.” - Adam Siegel, VP of Product Growth at Crexi

The office sector is entering what Colliers calls a "new equilibrium," with vacancy rates expected to drop below 18% nationally as more tenants return to the market. Cushman & Wakefield's analysis reveals that net absorption turned positive in the final six months of 2025, reaching 2.5 million square feet and marking the strongest back-to-back quarterly performance since early 2021. This momentum appears to be continuing into early 2026, as evidenced by Crexi's data showing improved vacancy and pricing stability.

The recovery story is nuanced by quality and location. CBRE reports that Class A demand has been positive for the past year, with competition growing for quality office space even as overall vacancy remains historically elevated. Crexi's market analysis notes that national office vacancy stood at approximately 18.9% as of the second quarter of 2025, with the market "finally finding its footing" three years after initial return-to-office pushes. The flight to quality continues to dominate tenant decisions, with newer prime space approaching full occupancy in many markets while secondary space faces extended downtimes.

Return-to-office mandates are accelerating: research indicates that while only 27% of companies have returned to fully in-person models, hybrid work remains the norm, with 52% of remote-capable employees in hybrid arrangements. However, 2026 is shaping up as a year of sharper in-office requirements, with multiple major employers increasing their in-office day requirements to four or five days per week. Office construction has hit 25-year lows, which, combined with improving demand, should continue to support vacancy compression and modest rent growth in quality buildings throughout 2026.

Investment Implications: Office investors should approach 2026 with a quality-first strategy, targeting Class A properties in strong submarkets where vacancy compression and return-to-office momentum are most evident. The 8.03% year-over-year price appreciation and improving vacancy metrics signal that the sector has likely bottomed, creating opportunities for value investors willing to underwrite transitional assets in markets with positive absorption trends. However, secondary and tertiary properties remain risky, as the widening performance gap between trophy assets and commodity space suggests continued bifurcation throughout the year.

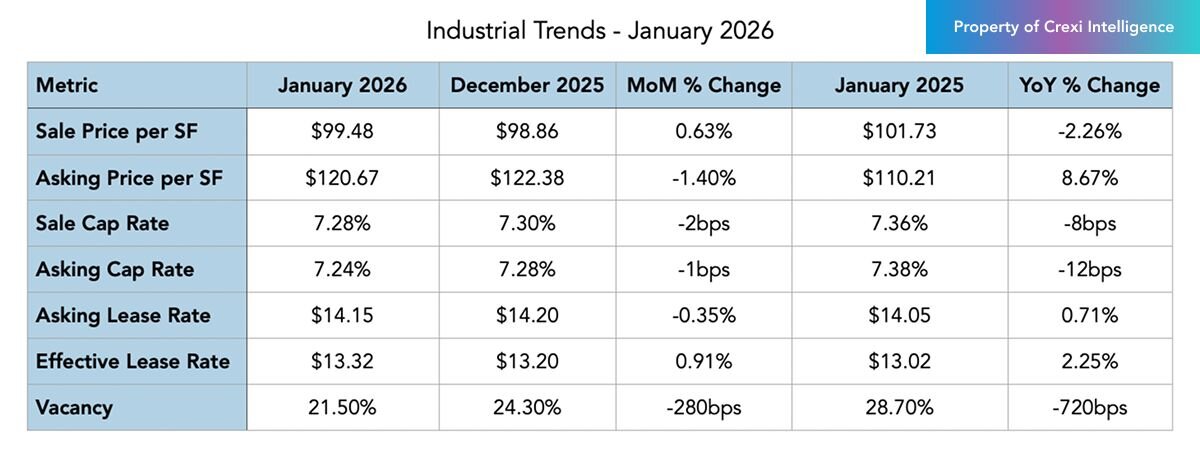

Industrial Market Analysis

For Sale

Pricing: Industrial sale prices on Crexi rose 0.63% in January to $99.48 per square foot from December's $98.86, though they remain 2.26% below January 2025's $101.73. This year-over-year decline reflects the sector's ongoing adjustment after pandemic-era peaks. Asking prices showed a mixed picture, declining 1.40% month over month to $120.67 from $122.38 but demonstrating strong 8.67% year-over-year growth from $110.21.

Cap Rates: Sale cap rates compressed 2 basis points to 7.28% in January from December's 7.30%, continuing their downward trend with an 8-basis-point tightening year over year from 7.36%. Asking cap rates similarly compressed 1 basis point month over month to 7.24% and 12 basis points year over year, signaling improving investor confidence and stronger operational performance across the industrial sector.

Vacancy: Industrial vacancy on Crexi's marketplace showed dramatic improvement, falling to 21.50% in January from 24.30% in December, a substantial 280-basis-point monthly decline. Year-over-year improvement is even more pronounced, with vacancy dropping 720 basis points from January 2025's 28.70%. This significant tightening reflects strengthening demand dynamics and moderating new supply.

For Lease

Asking vs. Effective Lease Rates: Asking lease rates declined 0.35% in January to $14.15 per square foot from December's $14.20, while posting 0.71% year-over-year growth from $14.05. Effective lease rates moved in the opposite direction, rising 0.91% month over month to $13.32 from $13.20 and climbing 2.25% year over year from $13.02. The narrowing spread between asking and effective rates suggests landlords are offering fewer concessions as vacancy tightens.

The Big Picture

“Industrial real estate, after several years of fluctuations, appears to be stabilizing. Following a period of rapid construction that added significant new supply to the market, we are now seeing increased absorption of space, which is helping to stabilize rents nationwide.” - Adam Siegel, VP of Product Growth at Crexi

Cushman & Wakefield's latest analysis reveals that the U.S. industrial market closed 2025 with strengthening fundamentals, with vacancy stabilizing nationally at 7.1% for two consecutive quarters, suggesting the market may be nearing peak vacancy. Fourth-quarter net absorption reached 54.5 million square feet, up 29% from the fourth quarter of 2024, lifting full-year absorption to 176.8 million square feet, a 16.3% increase and marking the strongest six-month demand trend since 2023. This momentum aligns with Crexi's data showing substantial vacancy compression and improving pricing power.

The supply-demand balance is shifting favorably for landlords. Full-year leasing in 2025 reached 665 million square feet, the highest annual total since 2022, with 43 leases exceeding 1 million square feet signed during the year. Construction activity continued to cool, with developers delivering 281 million square feet in 2025, down 35% from 2024 and the lowest annual total since 2017. This supply moderation is helping prevent further upward pressure on vacancy, with fourth-quarter deliveries falling 24% year-over-year.

Looking ahead, CNBC reports that third-party logistics firms are leading demand, with third-quarter absorption far exceeding the entire first half of the year, indicating supply and demand are moving into better balance. Prologis predicts that U.S. warehouse utilization will reach expansionary levels as customers max out current space and start new leases, with e-commerce companies expected to account for nearly 25% of new leasing in 2026. The sector is also benefiting from nearshoring and reshoring trends, with manufacturing construction driving additional warehouse demand. While some markets experienced vacancy above 7% during 2025's supply wave, market fundamentals show early signs of stabilization as construction pipelines have contracted 60% from their 2022 peak, setting the stage for continued improvement throughout 2026.

Investment Implications: Watch for selective opportunities in modern, well-located logistics facilities where fundamentals are stabilizing first. Headline asking prices may stay elevated while sold pricing softens in commodity stock; focus on submarkets with infrastructure advantages, limited new supply and build-to-suit activity as leading indicators of near-term rent growth recovery in 2026.

Multifamily Market Analysis

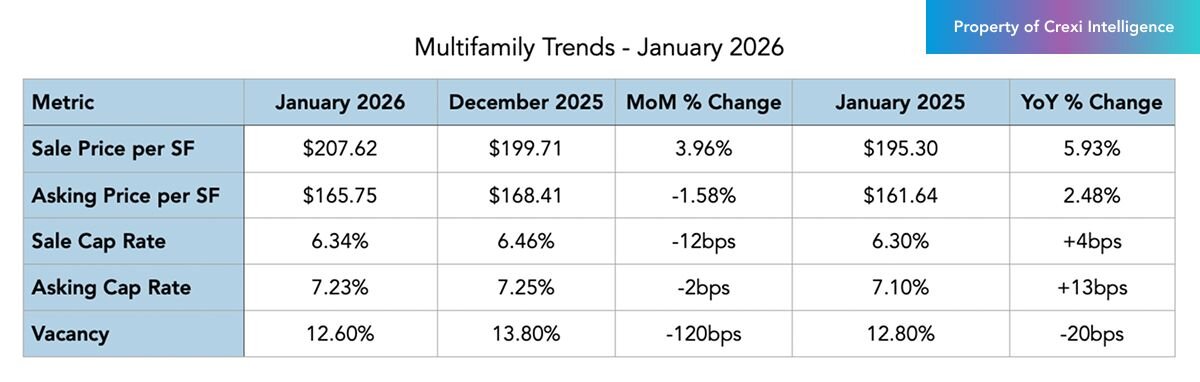

For Sale

Pricing: Multifamily sale prices on Crexi accelerated in January, rising 3.96% to $207.62 per square foot from December's $199.71, representing a strong 5.93% year-over-year increase from January 2025's $195.30. Asking prices moved in the opposite direction, declining 1.58% month over month to $165.75 from $168.41 but maintaining 2.48% year-over-year growth from $161.64. The divergence between realized sale prices and asking prices suggests competitive bidding for quality assets.

Cap Rates: Sale cap rates compressed 12 basis points to 6.34% in January from December's 6.46%, though they remain 4 basis points wider than January 2025's 6.30%. Asking cap rates tightened 2 basis points month over month to 7.23% and widened 13 basis points year over year from 7.10%, reflecting seller optimism about improving fundamentals even as cap rates remain elevated compared with pre-pandemic levels.

Vacancy: Multifamily vacancy on Crexi improved dramatically to 12.60% in January from 13.80% in December, a 120-basis-point monthly decline. Year-over-year vacancy also tightened 20 basis points from 12.80%, suggesting the sector may be reaching an inflection point as new supply moderates and absorption strengthens.

The Big Picture

The multifamily sector is entering what the National Apartment Association characterizes as "a year of transition and recovery," with supply beginning to slow and demand stabilizing after an unusually intense construction cycle. After multifamily construction peaked in 2024 with more than 700,000 apartments added in a single year, completions decreased by about 20% in 2025, with the construction pipeline projected to continue declining in 2026. This supply moderation is critical: Cushman & Wakefield reports that 2025 apartment demand totaled approximately 355,000 units, marking the third-highest annual absorption in the past 25 years.

Vacancy dynamics are shifting favorably. While national multifamily vacancy reached approximately 8.5% by year-end 2025, industry forecasts anticipate gradual declines throughout 2026 as the supply-demand balance improves. Crexi's data showing vacancy compression to 12.60% suggests many markets are already seeing this improvement materialize. CBRE projects that as the construction pipeline shrinks, strong renter demand will lower vacancy rates and precipitate above-average rent growth in 2026.

Rent growth is expected to regain momentum after a challenging 2024-2025 period. National rents rose by just 0.2% through mid-December 2025, with some markets experiencing declines. However, the consensus outlook for 2026 points to rent growth of approximately 2%, with potential for stronger performance in the second half as vacancy improves. The National Apartment Association projects that after a flat 2024-2025 rent environment, pricing power is expected to return in 2026 and strengthen into 2027, with rent growth moving toward 2.0% on a yearly basis.

Regional performance varies significantly. Sun Belt markets, which struggled with oversupply and declining rents in 2025, are expected to see gradual recovery as new supply moderates. Meanwhile, Northeast and Midwest markets, which saw limited new construction, are positioned for stronger rent growth of 4%-5% annually.

The multifamily sector also benefits from structural tailwinds: with mortgage payments averaging 35% higher than apartment rents, many households continue renting rather than buying, keeping demand strong even as economic growth moderates. Colliers notes that multifamily has led investment sales volume since 2015 and shows no signs of relinquishing that position, though its share may ease somewhat as investors allocate more capital to other sectors in 2026.

Investment Implications: Multifamily presents a contrarian opportunity in early 2026, as vacancy compression of 120 basis points month over month and slowing construction pipelines position the sector for a rent growth recovery in the second half of the year. Investors should focus on Class B properties in Midwest and Northeast markets where supply has been limited and rent growth is projected at 4%-5%, while approaching Sun Belt markets selectively as they work through remaining supply overhang. With sale prices up 5.93% year over year and cap rates compressing, the window for acquiring stabilized assets at attractive yields is narrowing, making this an opportune moment to deploy capital ahead of anticipated fundamental improvements.

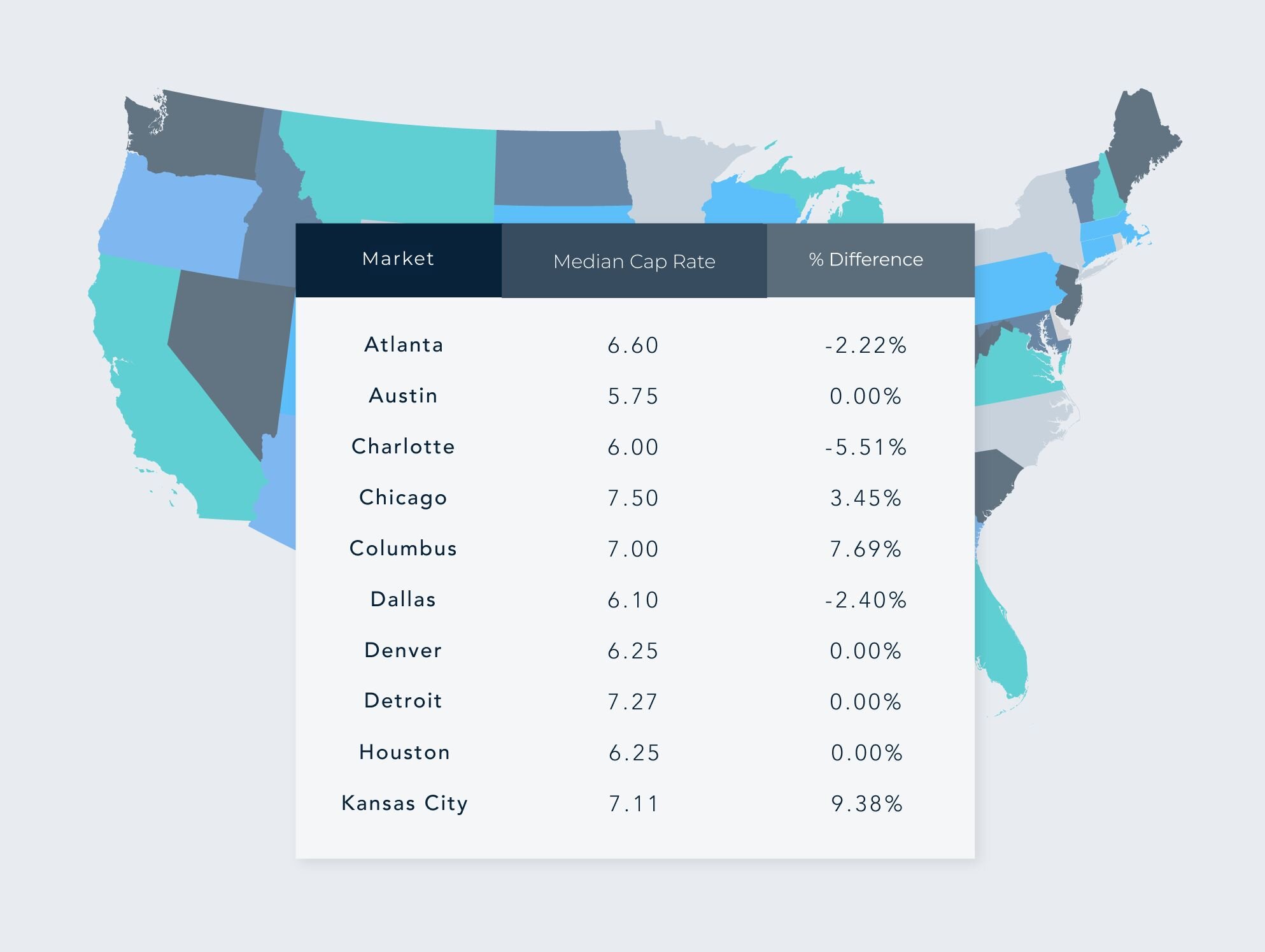

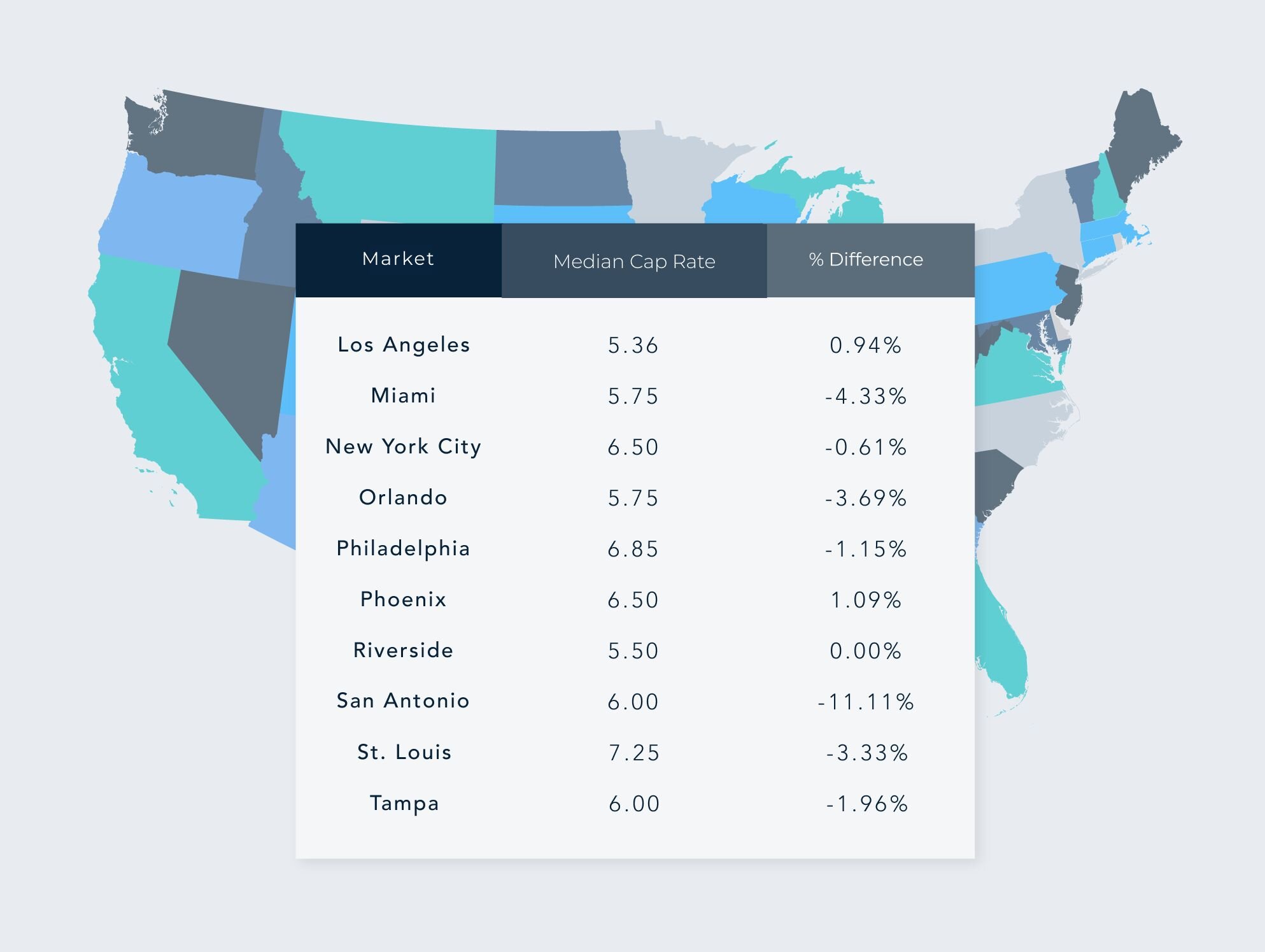

Regional Breakdown: Median Cap Rates & Changes MoM by Top MSAs – January 2026

Disclaimer: This article's information is based on Crexi's internal marketplace data and additional external sources. While asking price in many ways reflects market conditions, variations in pricing are affected by changes in inventory, asset size, etc. Nothing contained on this website is intended to be construed as investing advice. Any reference to an investment's past or potential performance should not be construed as a recommendation or guarantee towards a specific outcome.

Get more data-driven insights with Crexi Intelligence.