REITs vs. Direct Real Estate Investment: What’s the Right Choice for You?

Navigating real estate investing means understanding two major approaches: Real Estate Investment Trusts (REITs) and direct property ownership[1]. For example, REITs offer liquidity and professional management and direct investments provide more control, and though direct real estate can yield higher returns through leverage, it carries greater property-specific risks. Both options have unique advantages and challenges, and each fits different goals, budgets, and levels of involvement. Some investors may consider a hybrid approach to achieve diversification benefits.

This comprehensive guide explores the key differences, examining each approach's unique characteristics, advantages, and considerations to help investors make informed decisions in the commercial real estate market.

What is a REIT?

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-generating real estate, making it possible for individuals to invest in large-scale properties without buying or managing physical assets[2]. REITs are traded on public stock exchanges, allowing for easier entry and exit than owning a property outright. Professionals manage them and are legally required to pay out 90% of their taxable income to shareholders, making them a strong choice for investors seeking regular income and a hands-off investment experience.[3]

Types of REITs include three main categories, each catering to different investment interests[4].

- Equity REITs own and manage physical properties, such as office buildings, apartment complexes, and retail centers, providing investors with income primarily through rent collected from tenants.

- Mortgage REITs, on the other hand, focus on financing within the real estate sector, generating income from the interest on property loans rather than owning physical buildings.

- Hybrid REITs combine property ownership and real estate financing, offering a diversified approach by blending rental income from properties and interest income from loans.

Pros of REITs

- Liquidity: Easily traded on public exchanges, making it simple to buy or sell.

- Diversification: One REIT can cover multiple properties across regions and sectors.

- Passive Income: Provides regular dividend payouts without requiring active management.

- Low Entry Cost: Lower minimum investment requirements, sometimes under $1,000.

- Professional Management: Managed by professionals, saving investors from direct involvement.

Cons of REITs

- Market Sensitivity: Share prices can be affected by market volatility and interest rates.

- Limited Control: Investors have no say in management decisions or property-specific strategies.

- Taxed as Ordinary Income: Dividends may be taxed at ordinary income rates, which can be higher.

- Less Value-Add Potential: Fewer opportunities to increase income through property improvements.

What is Direct Real Estate Investment?

Direct real estate investment means buying and managing properties yourself. This can be anything from a single rental home to a commercial building. As the property owner, you control the asset and the management decisions, giving you the potential to directly influence your returns through property improvements or strategic rent increases.

Commercial real estate investment, compared to residential, focuses on properties used for business purposes. These may include office buildings, retail spaces, and industrial complexes. Commercial properties often result in higher returns due to longer lease terms and higher rental rates, making them attractive to investors seeking substantial cash flow.

Pros of Direct Real Estate Investment

- Control: Investors decide on property management, tenant selection, and improvements.

- Potential for Higher Returns: Possibility to boost returns through leverage and property appreciation.

- Tax Benefits: Deductions available for depreciation, interest, and maintenance.

- Income Growth Flexibility: Can increase income through property improvements or strategic rent adjustments.

Cons of Direct Real Estate Investment

- Illiquidity: Property sales can be time-consuming and involve high transaction costs.

- High Initial Capital: Significant upfront investment and ongoing maintenance costs are required.

- Management Demands: Requires hands-on involvement or hiring of a property manager.

- Property-Specific Risks: Vulnerable to local market conditions, vacancies, and unexpected repairs.

Comparing Performance: REITs vs. Direct Real Estate

Both REITs and direct real estate investments play crucial roles in a diversified portfolio, offering unique benefits and risk profiles. REITs provide investors with exposure to real estate without the need to own or manage physical properties, making them an attractive option for those seeking liquidity and lower entry costs[5].

Research suggests that allocating as little as 5% of a portfolio to REITs can lead to greater returns and reduced risks compared to a traditional 60/40 equity-bond mix[6]. Direct real estate investments, while requiring more capital and expertise, offer investors more control over decision-making, potential for substantial cash flow, and significant tax advantages[7]. The optimal allocation between REITs and direct real estate investments depends on an investor's goals, risk tolerance, and available resources.

Ownership structure and control

Direct real estate investors have full control over property choices, tenant selection, and property management, allowing them to tailor investments to specific criteria. However, they are responsible for all management tasks, including maintenance and tenant relations, which can be time-consuming and challenging. In contrast, REIT investors benefit from professional management without direct involvement, making it a passive approach suitable for those who prefer not to manage properties themselves.

Value-add potential and tax benefits

Direct real estate offers opportunities for “value-add” strategies, where investors can increase property value and rental income through improvements and renovations, potentially boosting returns[16]. Direct investments also allow for tax deductions, including property depreciation, which can reduce taxable income[9]. REITs, while offering fewer value-add opportunities, come with tax efficiencies like a 20% deduction on qualified dividends and avoidance of corporate taxes, providing a simpler but effective tax strategy for investors seeking passive income[17].

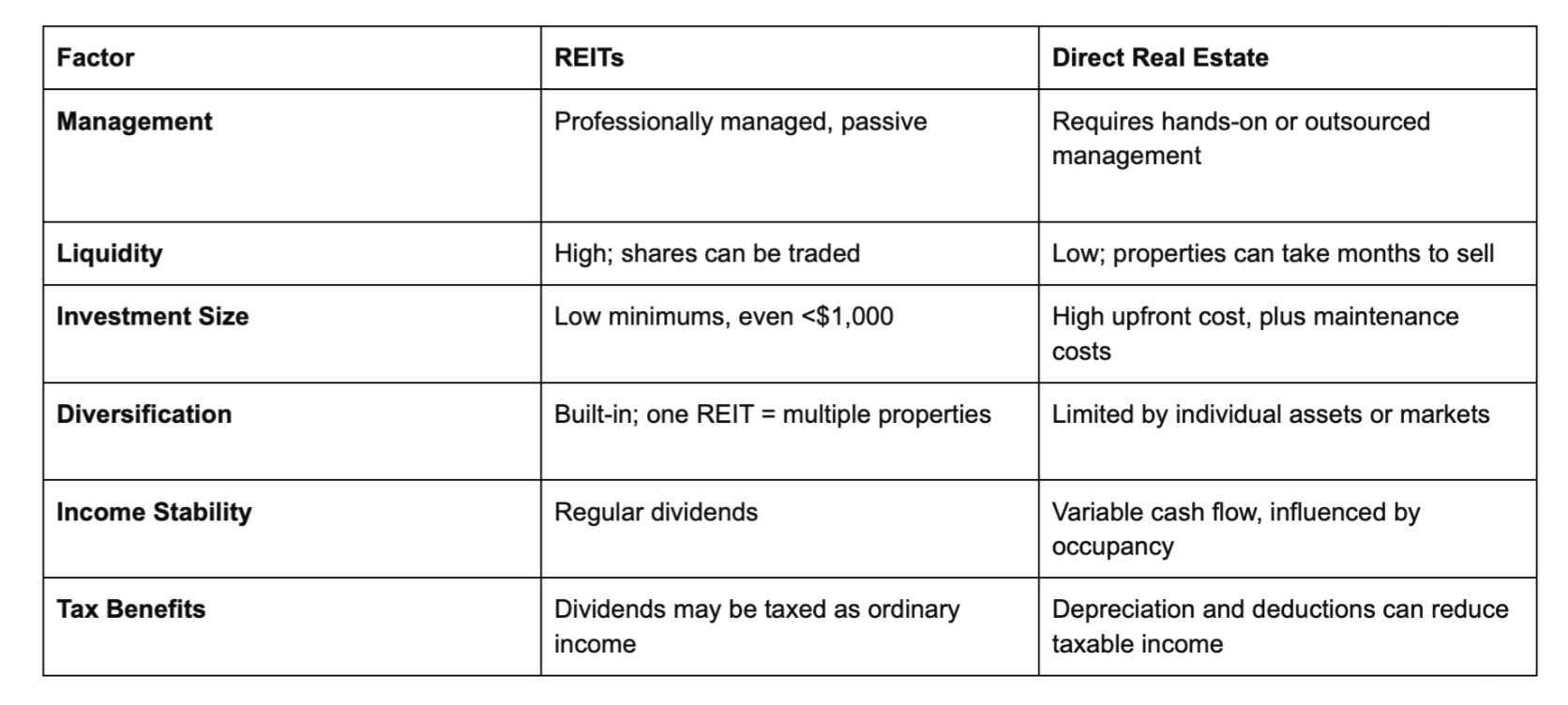

REITs vs. Direct Real Estate: A Side-by-Side Comparison

Income Performance

Investors in REITs benefit from dividend payouts, which provide steady income and can offer high yields relative to traditional stocks. Most REITs pay quarterly dividends, some even monthly, giving investors reliable cash flow without hands-on management. Conversely, rental income from direct investments varies more, especially with factors like market demand, property type, and occupancy rates. Many investors aim for positive cash flow after expenses—mortgages, taxes, and maintenance. Unlike REITs, rental income can grow through improvements or lease adjustments, but it takes more effort to maintain.

Historical returns and volatility

A 24-year study from 1998 to 2021 comparing REITs and direct real estate investments found that listed equity REITs delivered an average annual return of 10.9%, outperforming unlisted real estate investments, which averaged 8.6%[8]. This return gap persisted across various private real estate styles, highlighting REITs’ competitive performance among asset classes. Both REITs and direct real estate showed low correlations with other assets, offering diversification benefits, and had comparable volatilities of around 18.8% for REITs and 16.8% for unlisted real estate.

REITs, being publicly traded, are more sensitive to economic and interest rate shifts, leading to potential share price fluctuations but generally providing steady income due to diversified portfolios. In contrast, direct real estate investors face property-specific risks like repairs and vacancies, which can impact income but are often less influenced by stock market trends, responding instead to local market dynamics.

Correlation with broader market indices

The correlation between REITs and broader market indices is a crucial factor for investors seeking diversification benefits.While REITs have historically outperformed stocks over long-term periods, their correlation with the stock market has varied. According to data from Nareit, REITs have demonstrated a lower beta (0.75) compared to the S&P 500 (1.0), indicating less volatility[10].

This lower volatility suggests that REITs may offer some diversification benefits in a mixed-asset portfolio. However, the relationship between REITs and the broader market is complex and can change over time. Research has shown that in the short run, REITs may exhibit a higher correlation with the stock market, potentially due to market noise and investor sentiment.

Conversely, over longer horizons, REITs tend to more closely reflect the performance of their underlying real estate assets, potentially diverging from general stock market trends. This duality in REIT behavior presents both opportunities and challenges for investors seeking to optimize their portfolio allocations.

Investment Accessibility and Capital Requirements

Financing options for direct property purchases

For direct property purchases, financing options vary based on the investor’s profile and goals. Conventional loans are a common choice, generally requiring a down payment of 30% or more but offering competitive interest rates. Hard money loans cater to those needing fast funding, especially for short-term projects, though they come with higher rates. Private loans from family or individuals add flexibility but can carry personal risks. Other commercial loans support larger investments but require extensive paperwork and down payments. Alternative financing options, including seller financing, lease-to-own, and real estate crowdfunding, are also available and can provide creative solutions for those unable to secure traditional loans.

Impact of investment size on diversification

The impact of investment size on diversification varies significantly between REITs and direct real estate investments. REITs offer superior diversification opportunities for smaller investors, allowing them to gain exposure to a wide range of properties and markets with minimal capital. A REIT portfolio may include hundreds of properties across various sectors and geographic locations, providing instant diversification even with a modest investment.

In contrast, direct real estate investments typically require substantial capital, limiting the ability of smaller investors to diversify across multiple properties or markets. This concentration risk can be mitigated as the investment size increases, allowing for the acquisition of multiple properties or larger, more diverse assets. However, achieving the same level of diversification as REITs through direct investments would require significantly more capital and expertise.

The scalability of REITs also allows investors to easily adjust their exposure to real estate within their overall portfolio. In contrast, direct investments are less flexible due to their illiquid nature and higher transaction costs.

Management and Operational Considerations

REITs and direct real estate investments differ significantly in management and operational requirements. REITs offer a hands-off experience, as they are professionally managed, covering tenant selection, property maintenance, and financial oversight. This setup allows investors to gain real estate exposure with minimal involvement, making REITs ideal for those looking to avoid the complexities of direct property management.

In contrast, direct real estate investing requires a high degree of involvement. Investors must manage tenant relations, property upkeep, and compliance, often necessitating substantial time and expertise. Some direct investors hire property managers to handle these tasks, though it reduces profit margins. Ultimately, the choice between REITs and direct ownership hinges on the investor’s available time and willingness to manage the property directly.

Operational efficiency and economies of scale also favor REITs, which can leverage pooled capital from multiple investors to spread costs across a larger property portfolio. This scalability allows REITs to secure better financing terms and reduce per-unit operating expenses, often resulting in lower expense ratios. In contrast, individual investors generally lack this bargaining power, though local expertise can sometimes offer advantages in niche markets.

Transparency and reporting differ as well; REITs are required by the SEC to provide regular, detailed financial reports, offering transparency but also exposing them to potential market volatility due to investor sentiment. Direct investors don’t face standardized reporting but benefit from access to specific property information that may not be as readily available in a REIT structure. Each approach has trade-offs in time commitment, control, and operational transparency, so investors should weigh these factors based on their expertise and investment goals.

Risk Profiles: The Difference Between REITs and Direct Real Estate Investment

REITs and direct real estate investments respond differently to market risk and interest rates. As publicly traded securities, REITs are sensitive to market fluctuations and interest rate changes, often seeing share prices fall when interest rates rise. This connection to market sentiment can lead to short-term volatility. Direct real estate investments, however, are generally more stable in the short term, as they are less affected by immediate market shifts. Nonetheless, long-term economic trends and interest rate changes can still impact property values and financing costs for direct real estate.

Property-specific risks

Property-specific risks are a major consideration in direct real estate. Unlike REITs, which spread risk across many properties, direct investments concentrate risk in single assets, making them more vulnerable to unexpected maintenance issues, vacancies, or changes in local market conditions. Investors must account for costs related to property upkeep, tenant management, and potential legal or environmental issues, which can impact profitability. Successful direct real estate investing requires thorough due diligence and a strong understanding of local market dynamics.

Diversification

Diversification is another key difference. REITs offer built-in diversification across various properties, sectors, and regions, reducing exposure to any one market or property type. Direct real estate investments, in contrast, concentrate risk within specific properties or local markets unless substantial capital is used to acquire a variety of properties. While REITs provide automatic diversification, direct investors can capitalize on local opportunities that REITs might overlook, provided they have adequate knowledge and resources.

Leverage

Leverage amplifies potential returns but also increases risk. Direct investors often benefit from lower-cost mortgage financing, which can boost their return on equity (ROE). However, this leverage brings higher financial risk, as a downturn could lead to default. Though generally less leveraged for individual investors, REITs benefit from professional management and diversification, which can help manage property-specific risks. Investors must weigh their risk tolerance, capital, and preferred level of control when choosing between these investment types.

Income Generation and Cash Flow

Dividend yields from REITs

REITs are known for their attractive dividend yields, often higher than traditional stocks. By law, REITs must distribute at least 90% of taxable income to shareholders, which generally results in stable quarterly or even monthly dividends. Some REITs have demonstrated strong, consistent dividend growth, making them appealing to investors who want reliable income without hands-on property management. However, when evaluating REITs, it’s important to consider factors like leverage and payout ratios to gauge the long-term sustainability of these dividends.

Rental income and cash flow from direct properties

Income from direct property investment comes from rental payments after covering property expenses, including taxes, maintenance, and mortgage payments. A property’s cash flow depends on factors such as location, tenant stability, and management efficiency. While rental income can offer higher returns than REIT dividends, it’s less predictable and influenced by property-specific costs and vacancy rates. A common target is an 8–15% return on investment, but this varies with local market conditions and management strategy.

Stability and growth potential of income streams

REITs typically provide more stable income through consistent dividend payments, while direct investments have the potential for greater, albeit less predictable, cash flow from rental adjustments and property improvements. REITs benefit from diversification across multiple properties, which helps buffer against individual property performance issues, offering more stable income overall. In contrast, direct real estate investments allow for more flexible income growth as investors can actively improve properties, increase rents, and implement cost-saving measures. Each approach offers unique paths to income growth, with REITs aligning with passive income goals and direct real estate suiting investors focused on hands-on income expansion.

Exit Strategies and Liquidity Concerns

REITs offer high liquidity, allowing investors to buy and sell shares on stock exchanges easily, making them ideal for those needing quick access to capital. Direct real estate, however, is less liquid and requires a longer process to sell properties, often incurring transaction fees and taking months. While direct property owners can maximize returns through strategic timing and even benefit from tax-deferral options like 1031 exchanges, the process is generally slower than selling REIT shares[12].

Market timing and transaction costs also vary between these options. REITs allow investors to adjust to market changes quickly and at lower transaction costs, making it easy to respond to short-term fluctuations. Direct real estate investments, however, require a more strategic timing approach based on local market cycles, economic conditions, and interest rates. The high transaction costs in direct property sales necessitate a longer-term outlook to achieve maximum returns.

Real estate market conditions impact exit strategies as well. REITs provide flexibility to capitalize on market upswings or downturns, but share prices can fluctuate with broader market trends. In contrast, direct real estate investments depend more on local market dynamics, with potential appreciation during favorable periods but also greater vulnerability to downturns in specific regions. Interest rate changes can impact both, but REITs generally manage this impact better through diversified portfolios[13].

To enhance liquidity in direct real estate, investors can focus on properties in high-demand areas, maintain properties well, use technology for wider marketing, or choose shorter holding periods like fix-and-flip projects[14]. Alternatively, exploring REITs or real estate crowdfunding offers more flexible access to real estate markets[15].

Choosing Between REITs and Direct Real Estate Investment

Both REITs and direct real estate investments have unique roles in building wealth and diversifying a portfolio. REITs offer ease of entry, liquidity, and professional management, while direct investments offer control, potential for higher returns, and tax benefits. Ultimately, the best choice depends on your financial goals, risk tolerance, and personal involvement preference.

As you consider your options, remember that a balanced approach combining both REITs and direct investments can offer the benefits of diversification while allowing for targeted investments in specific markets or properties.

At Crexi, we're committed to providing the tools, data, and insights you need to make informed decisions about your real estate investments, whether you're interested in certain REITs, direct property ownership, or a combination of both.

Ready to explore your commercial real estate investment options? Explore properties on Crexi's platform to find opportunities that align with your investment goals and strategy.

References

- Morningstar. (2024). The Role of Real Estate Investments in a Portfolio.

- Nareit. (2024). What is a REIT?

- Investopedia. (2024). Real Estate Investment Trust (REIT).

- SmartAsset. (2024). Types of REITs.

- SmartAsset. (2024). Direct vs. Indirect Real Estate Investment.

- The Motley Fool. (2024). High-Dividend REITs: 3 Top Picks for Income Investors.

- U.S. Securities and Exchange Commission. (2024). Investor Bulletin: Real Estate Investment Trusts (REITs).

- Nareit. (2024). Updated CEM Benchmarking Study Highlights REIT Performance.

- Internal Revenue Service. (2024). Instructions for Form 1120-REIT.

- SparkRental. (2024). How Correlated Are Public REITs to Stock Markets?

- The White Coat Investor. (2024). Direct Real Estate Investing vs. REITs.

- Agency21. (2024). The Critical Role of Liquidity in Real Estate Investments.

- Hill Creek Commercial Capital. (2024). REITs vs. Direct Investment in Commercial Real Estate: Comparing Investment Vehicles and Their Implications.

- Steadily. (2024). What Is the Average Cash Flow on a Rental Property?

- Investopedia. (2024). Real Estate vs. REITs: What's the Difference?

- Rentastic. (2024). Real Estate Investment Trusts (REITs) vs. Direct Real Estate Investing: Pros and Cons.

- First National Realty Partners. (2024). Understanding Value-Added CRE Deals.

- Nuveen. (2024). Tax Benefits and Implications for REIT Investors.